3 Coins in the Top 50 That Could 3X Soon

By Pratik Bhuyan Updated October 4, 2025

Summary

- The crypto market is shifting toward mid-cap projects that combine strong narratives with room for significant growth.

- Sectors such as decentralized finance, artificial intelligence integration, and next generation blockchain infrastructure are emerging as major drivers of future growth.

- Certain coins within these sectors have catalysts in place that could lead to substantial price appreciation in the near term.

Introduction

Crypto does not reward blind patience, it rewards being early to narratives before they explode. While everyone is staring at Bitcoin’s ETF flows or Ethereum’s Layer-2 battles, a handful of mid-cap tokens quietly building in the background could be preparing for their next big moves. These are projects that are not small enough to be risky moonshots, but not so big that the upside is capped.

Today, we are diving into three mid-cap giants sitting comfortably in the top 50 that have a realistic shot at tripling in price over the next few months if their catalysts line up: Chainlink, Bittensor, and Sui.

And because the market always has a few dark horses, we also have some honorable mentions you will want to keep on your radar.

1. Chainlink (LINK) : Oracles Meet Institutions

Narrative: The quiet workhorse of crypto is becoming the bridge for real-world assets (RWAs) and institutional money.

Recent Moves:

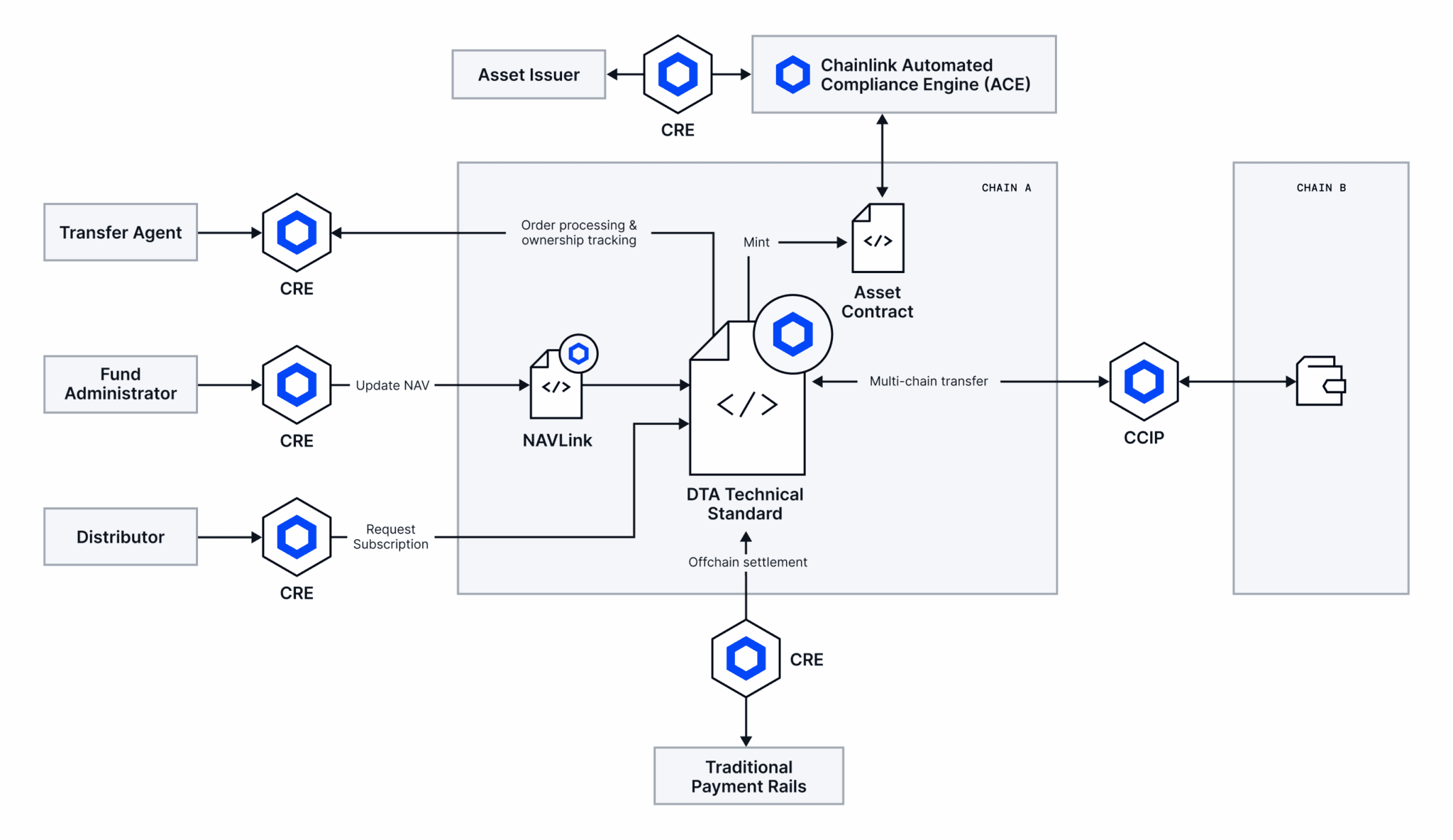

- Announced its Digital Transfer Agent (DTA) framework at Sibos 2025, bringing capital market infrastructure closer to blockchains.

- Expanding Chainlink Streams and Plasma, giving oracles sub-second latency for high-frequency finance.

- Growing adoption across DeFi, tokenization pilots, and staking.

Why 3x Potential Exists:

- Institutions need oracles, and if tokenized treasuries, funds, and ETFs are moving on-chain, Chainlink is the first phone call.

- Supply tightening via staking mechanics could create scarcity.

- Analysts are starting to project new demand cycles for LINK as RWA flows expand.

Chainlink's DTA Architecture

2. Bittensor (TAO) : The AI x Crypto Power Play

Narrative: If 2023 through 2025 has been the rise of AI, then Bittensor is crypto’s best attempt at decentralizing it. Think of it as a marketplace where anyone can train and contribute ML models, with incentives paid in TAO.

Recent Moves:

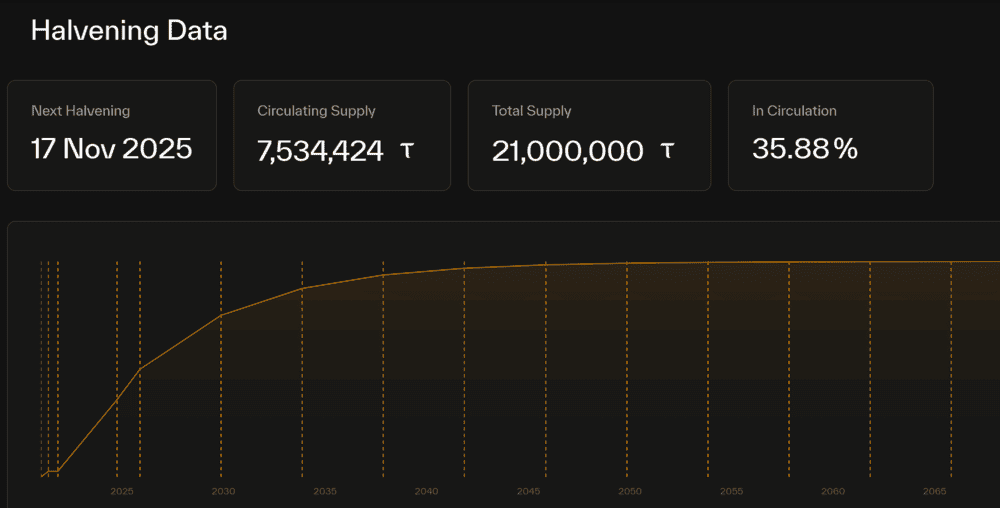

- First halving scheduled for December 11, 2025 that will cut emissions in half, creating a classic supply shock.

- Developer ecosystem pushing updates to improve model training incentives.

- Riding the broader AI meets blockchain narrative, one of the hottest sectors for money flow this year.

Why 3x Potential Exists:

- The halving sets up a textbook case of supply squeeze combined with narrative hype.

- Liquidity is thinner compared with L1s, so even modest capital rotation can cause large percentage moves.

- A single integration with a major AI company or application could accelerate adoption significantly.

TAO's Halvening Data

3. Sui (SUI) : The Liquidity Magnet

Narrative: Sui has been gaining ground as a developer-friendly Layer-1 and now it is about to get a serious liquidity boost.

Recent Moves:

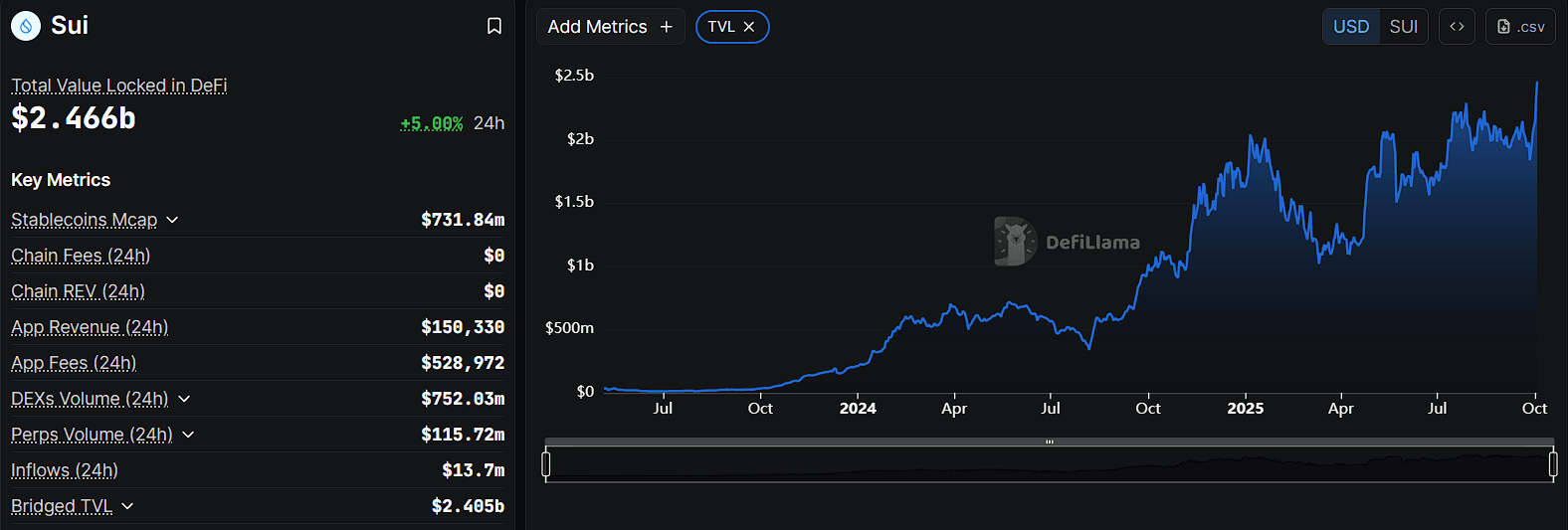

- Coinbase will launch Sui futures on Oct 20, 2025, a huge step for institutional access.

- Stablecoins are coming to Sui, announced by Sui Group, alongside integrations with hardware wallets.

- Expanding their DeFi ecosystem and trading products.

Why 3x Potential Exists:

- Futures listings tend to unlock higher liquidity, trading volume, and institutional attention.

- Native stablecoins bring real utility, TVL, and collateral use cases.

- Narrative momentum is building around “next-gen L1s” that are not clogged with gas wars.

SUI's Growing TVL

Some Honorable Mentions

Not everything makes the top three, but these names deserve a close look if you are hunting multipliers.

Avalanche (AVAX)

- Headlines around a potential $1B+ treasury and a corporate restructuring aimed at making Avalanche more institution-facing.

- If executed well, this could supercharge developer grants, liquidity, and overall perception.

Render (RNDR)

- Decentralized GPU network positioned at the center of AI and crypto.

- Strongly aligned with the surge of AI agents, GPU demand, and Ethereum integrations.

- One of the clearest “megatrend” narratives for 2025.

Aptos (APT)

- Recent stablecoin integrations and DeFi growth have given Aptos new momentum.

- Historically traded much higher, which suggests room for revaluation.

Closing Thoughts

We are entering a market where mid-caps can run harder than the big names because they combine fresh narratives with room to grow.

Chainlink stands out as the steady play, backed by growing institutional adoption and real-world integrations that give it staying power. Bittensor, on the other hand, is the high-volatility, high-upside bet, positioned at the intersection of AI and crypto, with its first halving on the horizon. Sui completes the trio as the liquidity magnet, with its upcoming futures launch and stablecoin integrations setting the stage for a surge in on-chain activity and trading volume.

The next few months could decide which of these mid-cap giants take the lead when altseason finally kicks in.

Disclaimer: Among the tokens discussed above, Aptos is an investor in Beluga. It's to be noted that, the views and opinions expressed in this article are solely those of the author and do not represent the views of Beluga. Beluga does not endorse or guarantee any forecasts or predictions mentioned. Cryptocurrency investments involve significant risk, and you should only invest after consulting with a qualified financial advisor.

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X