Can XRP Ever Hit $20? The XRP Army Thinks So, But Is It Possible?

By Pratik Bhuyan Updated August 6, 2025

Summary

- For XRP to hit $20 its market cap would need to exceed one trillion dollars making it the second most valuable crypto asset after Bitcoin.

- Such a valuation would require full regulatory clarity institutional adoption by banks and CBDCs and a massive surge in trading volume.

Introduction

If you've spent any time on Crypto Twitter (or X, whatever we're calling it these days), you've probably come across the die-hard XRP Army. These are the true believers who’ve stuck with Ripple’s native token through SEC lawsuits, brutal market cycles, and countless delays in “the big flippening.”

Their claim? XRP is destined to hit $20. Not a typo. Twenty. U.S. Dollars.

But what would that actually mean, and is it even remotely feasible? Let’s unpack the numbers, scenarios, and sheer magnitude of what it would take for XRP to hit that milestone.

First, Let’s Talk Market Cap Math

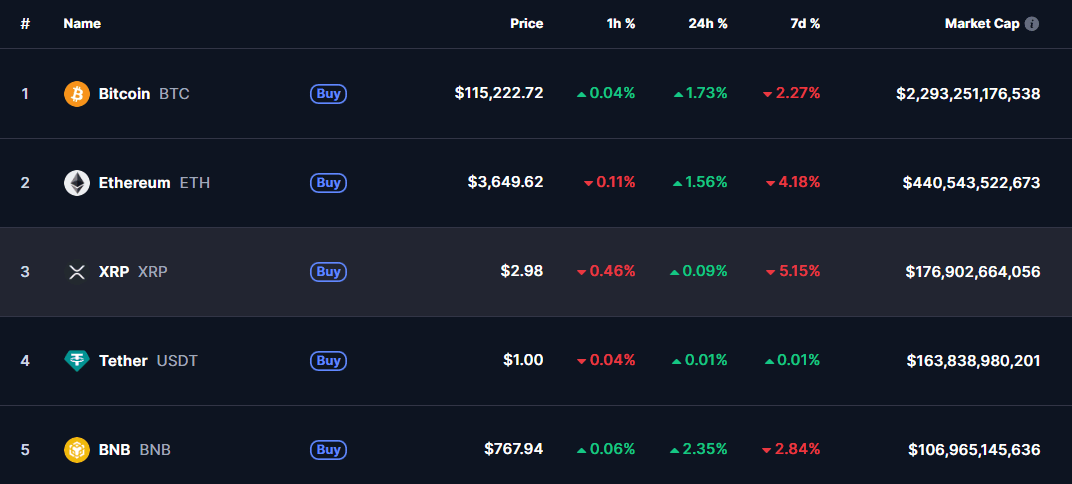

At the time of writing, XRP is trading at $2.98, with a circulating supply of about 55 billion tokens. If XRP were to hit $20, here’s what would happen:

$20 x 55 billion = $1.1 trillion market cap.

Yes, a Trillion. That would make XRP the second-largest crypto asset in the world, comfortably surpassing Ethereum, which sits at around $440 billion, and placing it right behind Bitcoin’s $2 trillion market cap.

So for XRP to hit $20, we’d need:

- A market cap that’s 2.5x Ethereum,

- And more than 50% of Bitcoin’s entire valuation.

That alone should make you pause and wonder.

How Would That Even Happen?

To justify a $1.1 trillion valuation, XRP would need massive catalysts and not just wishful thinking or hype-driven partnership announcements. Here’s what would realistically need to align:

1. Total Legal Clarity

The biggest regulatory hurdle has been the long-running SEC lawsuit. In March 2025, the SEC officially dropped the case, marking a landmark victory for Ripple and a major step toward clarifying XRP’s legal status in the U.S.

However, complete global regulatory certainty is still lacking. A full green light across jurisdictions could be the catalyst XRP needs to fulfil its ambition of becoming a cornerstone of global finance.

If XRP becomes the first fully compliant bridge asset for cross-border payments in both the U.S. and other jurisdictions, it could gain serious institutional demand.

2. Mainstream Adoption by Banks and CBDCs

Ripple has long pushed its narrative as a bridge currency between fiat currencies and central bank digital currencies (CBDCs). If XRP were to become the go-to liquidity provider for interbank settlements, remittances, and CBDC interoperability, demand could spike.

But here’s the kicker: most central banks are building their own infrastructure. And many are opting not to use any public blockchain assets. So far, there’s no sign that XRP will be plugged in on a large scale.

3. Massive Trading Volume

To sustain a $20 price, you’d need multi-billion-dollar daily trading volume, likely in the range of $20 billion or more per day to ensure liquidity and avoid flash crashes.

For reference, XRP’s current daily volume hovers between $3-$5 billion, depending on market conditions. That means it would need a consistently massive increase in daily volume, several times higher than it is now.

4. Broader Bull Market & Bitcoin Going Parabolic

Let’s be honest. XRP won’t hit $20 in a vacuum. The entire crypto market would need to be in full-blown euphoria, with Bitcoin likely north of $750,000 and Ethereum past $20,000. Only in such a mega-tsunami-like bull cycle could XRP even dream of breaking into the trillion-dollar club.

Let’s Compare It to Other Assets

For context, here are some current market caps (as of August 2025):

So for XRP to go from $177 billion to $1 trillion, it would need to 5.65x from here. It is not impossible in crypto, but it is extremely rare at this scale.

To illustrate how extreme that is: XRP would have a higher market cap than Amazon, Tesla, or Meta today. It would be one of the most valuable assets in the entire world!

What’s Actually Possible?

Let’s look at more realistic price targets based on varying market conditions:

XRP Price | Market Cap | Notes |

| $5 | $297B | Still achievable with the right positive catalyst. |

| $10 | $550B | Needs “major” institutional adoption |

| $20 | $1.1T | Needs global banking dominance |

A $4–$5 XRP is arguably within reach in a strong bull run, especially if Ripple secures a real-world use case and adoption by a major client or market. Anything above $10 would require either:

- Insane speculative mania

- Massive utility adoption by banks

- Or XRP being at the centre of a CBDC revolution.

So, Is $20 XRP Possible?

Well, technically it is possible, but realistically it is highly unlikely.

Unless Ripple becomes the de facto global liquidity layer for finance (on par with Swift or Visa) it’s hard to see XRP hitting $20 without the entire world shifting its financial infrastructure to RippleNet.

And right now, the signs aren’t pointing that way. Adoption is happening, sure, but slowly, and not at a scale to justify a trillion-dollar XRP.

Final Thoughts

The XRP Army isn’t crazy for dreaming big. But $20 XRP is more of a moonshot fantasy than a grounded prediction. That said, a return to $5–$6 seems well within reach during a proper altcoin season, especially if Ripple keeps winning in court and lands meaningful partnerships.

So stay grounded, do your own research, and remember: just because it can happen doesn’t mean it will.

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X