Lit Protocol Unleashes Vincent: The AI Agent Portoflio Manager You Can Trust

By Will McKinnon Updated October 17, 2025

Summary

- Leveraging threshold cryptography, trusted execution environments (TEEs), and now Vincent, Lit provides developers and users with critical infrastructure for managing secrets and agent-driven trading activities.

- Onchain policies enforce your rules automatically before any transaction, and the system runs within secure enclaves for additional protection.

- LITKEY points represent a future stake in Lit Protocol’s token distribution, which is slated to come soon. With total assets managed on Lit Protocol over $300 million, the $250 million FDV estimate may be conservative.

Introduction

The promise of AI agents managing your DeFi portfolio is finally coming to fruition with Lit Protocol’s Vincent platform, offering early access to a system that lets AI agents handle real funds safely and under your control. Lit Protocol is a decentralized key management and compute network that enables programmable key management across blockchain applications. Leveraging threshold cryptography, trusted execution environments (TEEs), and now Vincent, Lit provides developers and users with critical infrastructure for managing secrets and agent-driven trading activities. The LITKEY token will be launching soon, so now is a great time to get involved in the Lit Protocol ecosystem.

How Vincent Works

Vincent’s architecture centers on a few key innovations: Threshold cryptography distributes key management across Lit protocol’s network, meaning no single entity controls your private keys. Onchain policies enforce your rules automatically before any transaction, and the system runs within secure enclaves for additional protection. This creates a secure transaction delegation system, designed to facilitate agent-managed workflows to make a trader’s life easier.

This builds on Lit Protocol's proven threshold cryptography network, which has secured over $250M in digital assets and over 1.6 million unique wallets so far according to data from Dune. As opposed to many competitors, Vincent doesn’t give AI agents carte blanche access to do what they want with your funds. Rather, you grant specific, revocable permissions for discrete actions like swapping on UniSwap, lending on Aave, or bridging via deBridge. The actions it can take are endless, but only within your given parameters.

From a developer’s perspective, you can create a Vincent app which consists of one or more agents to run the logic, a set of required abilities for the user to grant the agent(s), and optional policies which dictate how those abilities can be used. An ability is defined as a single composable action, for example borrowing on Aave or swapping on Uniswap, and policies offer parameters under which those operations can be made (frequency of transactions, maximum value of transactions, etc). If you’re looking to get started building on Vincent, check out this starter repo provided by the Lit Protocol team.

The Opportunity

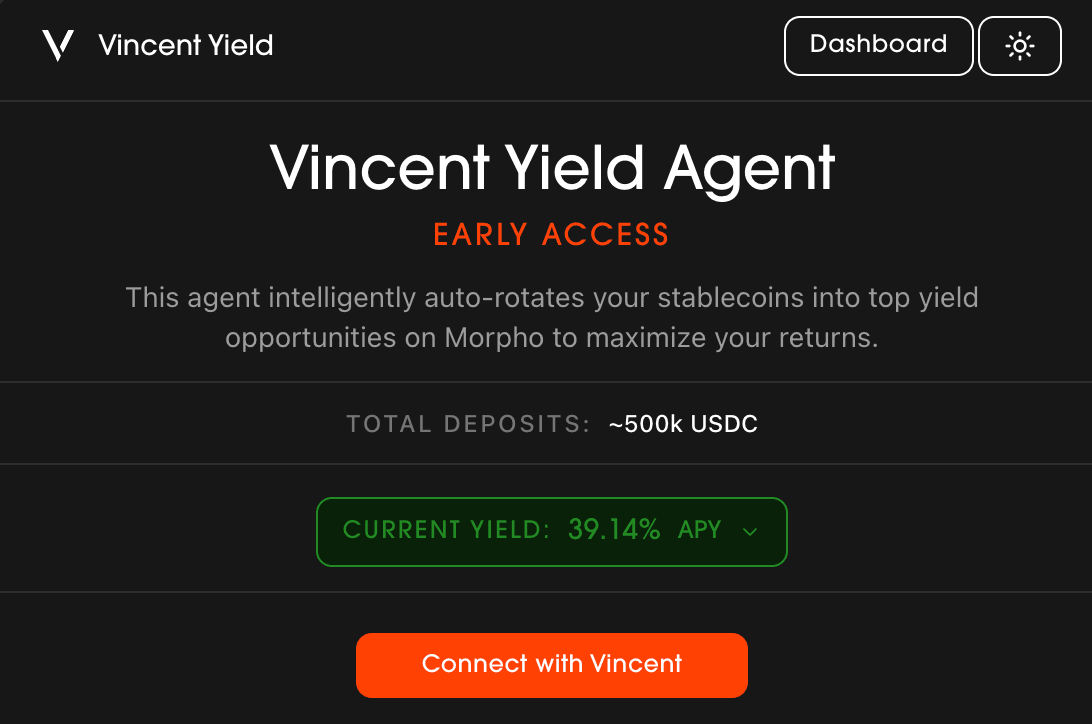

Early access to Vincent Yield is now live, which delivers autonomous yield optimization through Morpho’s high APY vaults without ongoing management. Currently participants can earn up to 40% APY on USDC deposits. This high return is generated through a combination of real yield paid out in USDC, as well as LITKEY points. These will eventually convert to LITKEY tokens upon TGE, with the valuation estimated at a $250 million FDV. This means users can farm the highest yields on USDC on Base while still capturing upside in the future LITKEY token.

Once you deposit USDC, Vincent rebalances your funds across Morpho vaults to capture the highest yields. No manual monitoring, no gas fees for rebalancing, no missed opportunities. Your DeFi quant works 24/7.

Vincent Yield: A DeFi Quant in Your Pocket

Vincent Yield focuses on what DeFi users want: maximizing stablecoin returns without constant portfolio babysitting. When you deposit USDC, the agent evaluates opportunities across all Morpho’s curated USDC lending pools. It monitors yield fluctuations, liquidity concerns and risk parameters to keep your funds optimally deployed. If the base yield on USDC isn’t enough, there is a significant reward boost stemming from the LITKEY points you accumulate just by depositing. These represent a future stake in Lit Protocol’s token distribution, which is slated to come soon. With total assets managed on Lit Protocol over $260 million, the $250 million FDV estimate may be conservative.

While this is an exciting implementation, Vincent Yield predominantly serves as a reference to what’s possible for developers building on the Vincent platform – if you fit this description, head over to the Vincent developer dashboard to get started building on its next-gen platform.

Getting Started with Vincent Yield

If you want to try it out for yourself, visit the Vincent Yield dashboard and connect your wallet or any supported social login method of your choosing. From there you can deposit any amount of USDC with a minimum deposit of $50 to activate the agent – it may be a good idea to start with a small amount for testing purposes before you make a larger deposit.

The dashboard provides real-time visibility into the USDC yield as well as any onchain actions your agent takes, updating as your agent rebalances funds. If you want to withdraw, follow the instructions on the dashboard using WalletConnect. USDC rewards will show as they stack up on the dashboard, and deposits will earn LITKEY points which will be redeemable for tokens upon the upcoming LITKEY TGE.

Wrapping Up

For the first time, users can rest easy with funds deployed with an AI agent handling real transactions. The combination of high yields, battle-tested security infrastructure, and early access to agentic technology makes Vincent a pretty compelling opportunity for DeFi farmers and crypto users in general.

We’re rapidly moving towards a world where manual portfolio management will give way to agent-powered automation, and Vincent is a step in the right direction. Whether you’re seeking higher yields on stablecoins, exposure to the upcoming LITKEY token, or just want to explore the next generation of DeFi infrastructure, Vincent is the place to be looking.

Liked this article and want to learn more about Lit Protocol? Follow them on Twitter, go directly to Vincent Yield, or visit the Vincent Developer Dashboard!

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X