Top 10 Crypto VCs that Built the Crypto Industry

By Sonny Singh Updated February 16, 2026

Introduction

Venture capitalists have played a very important role in growing the crypto ecosystem. Presently, there are numerous VCs focused on the crypto space along with many corporations that have their own corporate VCs. Many large blockchains and tokens also have their own venture team helping to grow their ecosystem. However, this wasn’t always the case. In 2013, most traditional VCs were just dabbling in crypto and three VCs decided to go fully into crypto. These three VCs - Digital Currency Group, Pantera Capital and Blockchain Capital - went against normal thinking and started dedicated crypto VC funds.

As you could imagine, it was very hard to raise money, and they started off writing small seed checks in 2013 and 2014. These three VCs would invest in the majority of crypto companies which was against the normal VC model of only investing in one company per industry. These VCs help seed the first large crypto companies like Coinbase, Ripple, BitPay, Xapo, Circle, Kraken and Blockchain.com. When crypto winter happened in 2015, they kept investing even though many of their portfolio companies went bankrupt. DCG ended up buying Coindesk and launching Grayscale while Blockchain Capital and Pantera kept grinding away and stayed focused on crypto.

Today, many crypto VCs have billions of dollars under management which is more than some of the most well known traditional Silicon Valley VCs. Many Crypto VCs have returns better than the most reputable Silicon Valley VCs. This list is not about the VCs with the best returns but rather the VCs who have made the greatest contribution to the crypto industry.

Many of these crypto VC firms have become well known, while the individual investing partner might not be as well known. Here is our list of the top 10 Crypto VC investors:

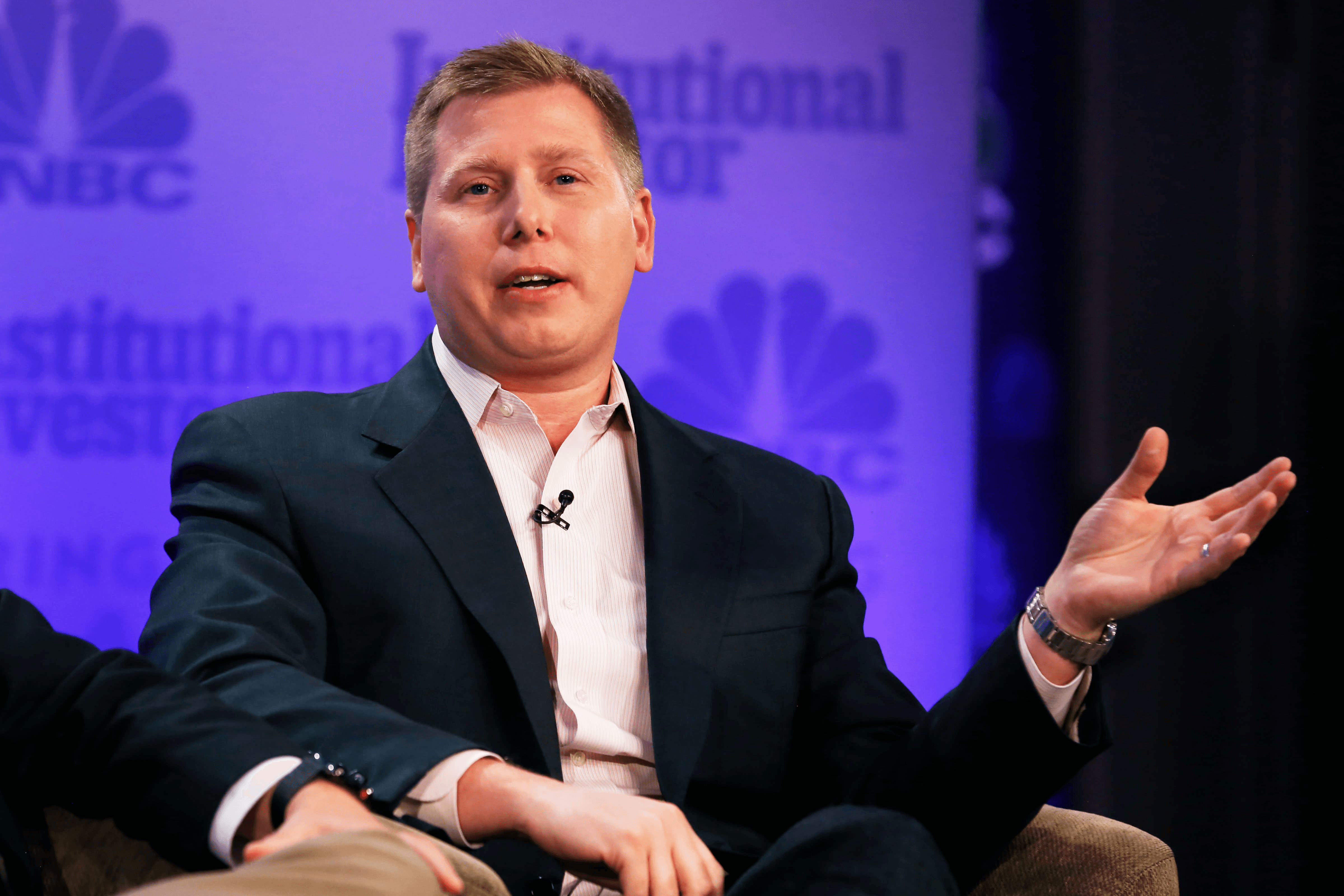

#1 Barry Silbert - Digital Currency Group (DCG)

Barry Silbert is one of the pioneers in the crypto industry whose investments have made crypto into the $3 trillion dollar industry its become. On the investment side, DCG has invested in over 200 companies. Barry was writing the first checks in 2013 and 2014 into crypto companies like Coinbase, Kraken, BitPay, Ripple, Circle, and Chainalysis. When most investors got scared during the crypto winter in 2015, Barry kept investing and bought Coindesk and launched Grayscale, which is the largest crypto-focused asset manager, and paved the way for the first crypto ETFs. DCG also operates Foundry which is the one of the largest Bitcoin mining pools and Luno which is one of the leading crypto investment platforms in emerging markets. DCG has a portfolio of over 250 early-stage investments across 40 countries.

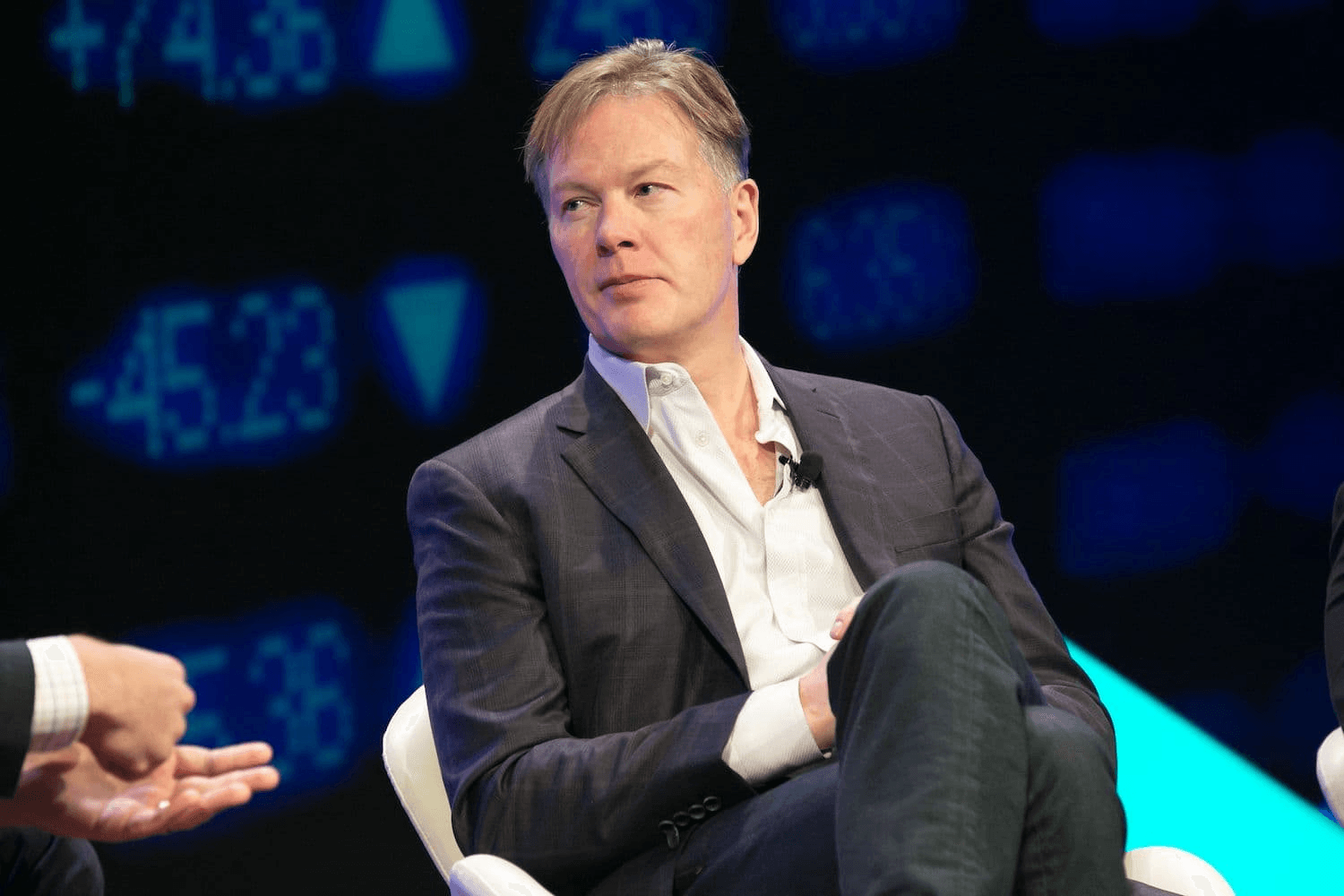

#2 Dan Morehead & Paul Veradittakit - Pantera Capital

Dan Morehead started Pantera Capital in 2013 after a very successful Wall Street career working at some of the most prestigious firms like Tiger Global and Goldman Sachs. One of Dan’s first hires was Paul Veradittakit in 2014, who was a young investor who helped Dan invest in hundreds of companies, including Coinbase, Ripple, Bitstamp, and Alchemy. Pantera also bought and sold a position in Bitstamp and launched one of the first token-focused funds.

3. Bart & Brad Stephens - Blockchain Capital

Bart and Brad Stephens founded Blockchain Capital in 2013 after several years of working in finance in San Francisco. They have invested in hundreds of crypto companies, including Coinbase, Kraken, Ripple, Circle, OpenSea, and Block.one, Bitwise, and Anchorage. Bart and Brad have always been practical investors, even when crypto was booming or crashing. They were the first venture fund to launch their own token (BCAP). Blockchain Capital currently has over $2B under management.

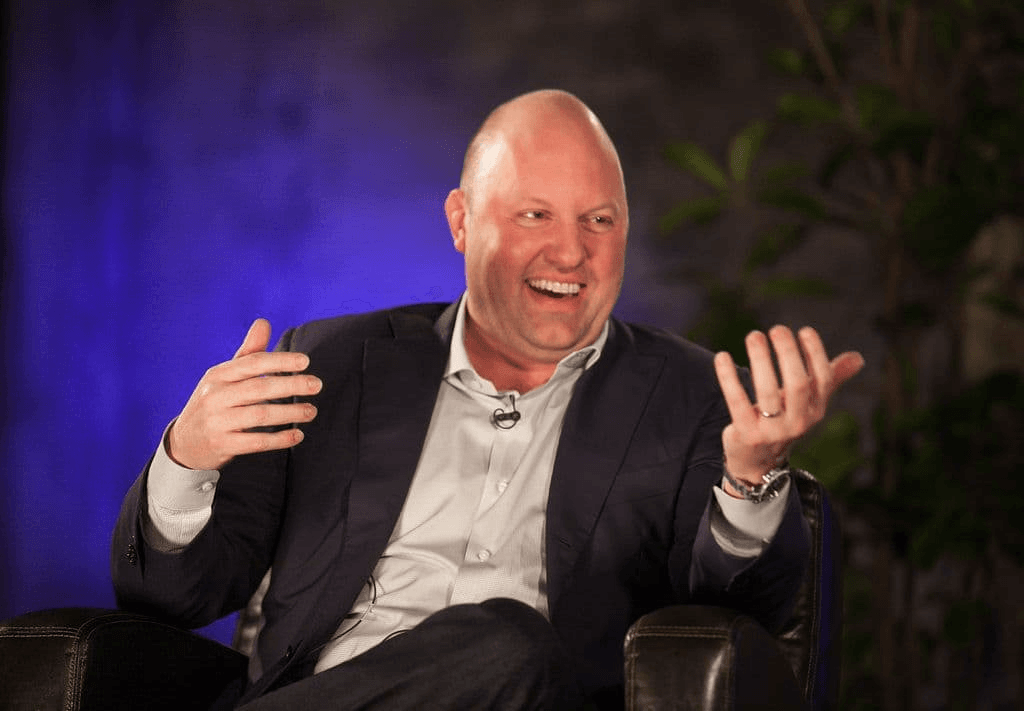

4. Marc Andreessen - A16Z

Marc Andreessen is a Silicon Valley legend, having started Netscape as well as the venture firm Andreessen Horowitz (A16Z). A16Z has become one of the top silicon valley VC firms investing in well known tech companies like Facebook, AirBnB, Pinterest, Stripe, Robinhood, Lyft, and Slack. They also wrote one of the first checks in Coinbase’s $5M series A round in 2013 and Marc was on the board of Coinbase when it went public. Marc was an early advocate of crypto and was the first traditional VC to launch a crypto specific fund. A16Z also began working with government officials and lobbyists to promote cryptocurrency. They have invested in numerous crypto companies including Coinbase, Opensea, MakerDAO, Compound, Filecoin, and Anchorage. Chris Dixon currently leads A16Z Crypto, but Marc had the vision to start investing.

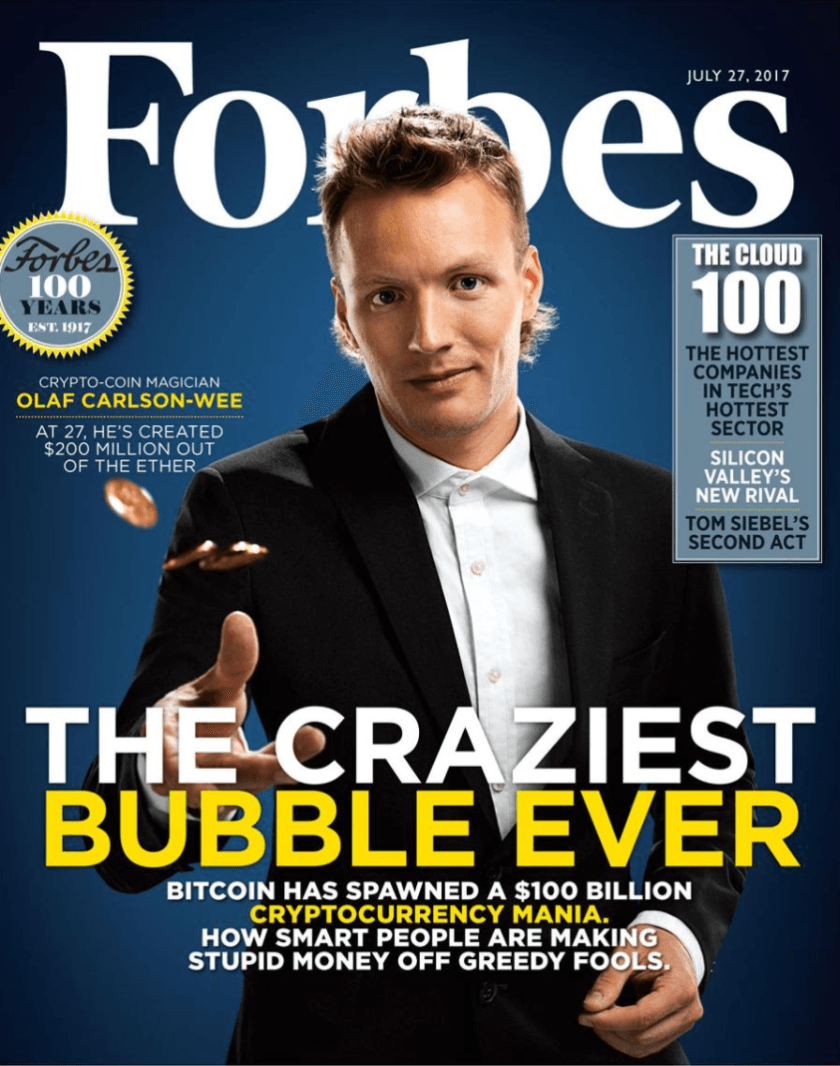

5. Olaf Carlson-Wee - Polychain Capital

Olaf was very instrumental in the rise of crypto-focused VCs, as he was really the first person to launch a large crypto VC fund after the crypto winter of 2015. Olaf’s story is classic crypto as he was a student at Vassar College when he read the Bitcoin Whitepaper and emailed Coinbase CEO Brian Armstrong in 2013. He ended up getting the job as Coinbase’s first employee, managing customer support and everything else. He also agreed to take 100% of his salary in Bitcoin. When Ethereum was doing the ICO, Olaf decided to leave Coinbase and start Polychain Capital. He raised money from top VCs like A16Z, Sequoia, and Union Square Ventures and invested in both equity and tokens. The ICO boom happened in 2017 and Olaf made some legendary investments into Ethereum, Filecoin, Chainlink, Compound and Uniswap. Olaf became the poster boy for crypto when he appeared on the cover of Forbes Magazine.

6. David Garcia - Borderless Capital

David founded Borderless Capital in 2017 after helping launch the Algorand token. David started out in crypto in 2014 with BitPagos (now Ripio) which is one of the largest exchanges in Latin America. He then helped launch Alogrand and became one of the first VCs that was involved with a blockchain. Borderless Capital has become one of the most prolific crypto investors, having invested in over 100 companies, including Arweave, Epic Games, Filecoin, Kraken, and Polkadot.

Disclosure: Both David and Borderless Capital are investors in Beluga

7. Jim Robinson - RRE

Jim Robinson helped start RRE Ventures in 1994 in New York and became one of the first VC firms focused on FinTech. In 2013, Jim started investing in crypto and was one of the first investors into Coinbase, BitPay, Blockchain.com, DCG, Chain, Blockstream, Abra, Ripple and 21.co. Having RRE invest in crypto gave a lot of credibility to the crypto industry.

Disclosure: Jim is an investor in Beluga

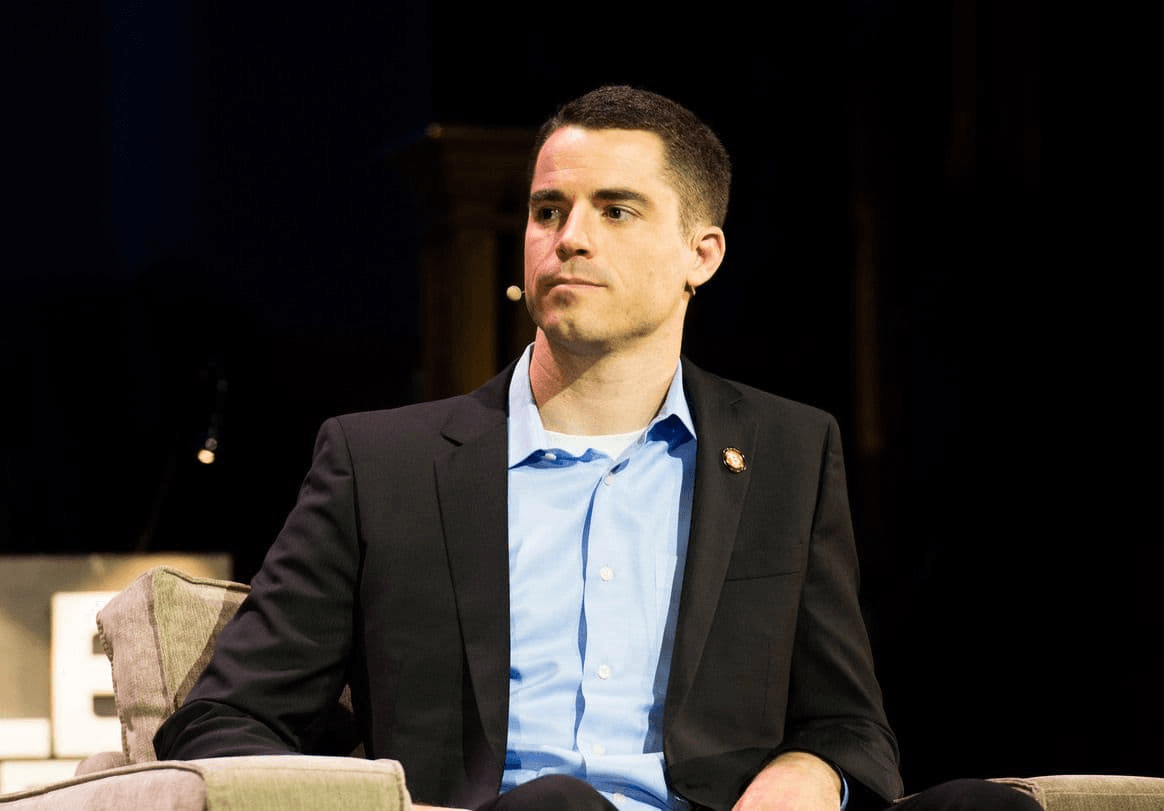

8. Roger Ver - Angel investor

Roger wrote some of the first checks in Kraken, Ripple, BitPay, Blockchain.com and ZCash

Roger Ver might not be well known to many people who got into crypto in the last couple of years, but he is one of the most controversial people in the world of crypto. Roger was one of the first investors in crypto before VCs were investing in crypto. Things got really toxic for Roger when he got involved with Bitcoin Cash causing a riff between the communities. He was later arrested by the US Government for tax evasion but has since settled with the government. Check out our interview we did with Roger shortly after arrests where he talks about his career in the crypto industry.

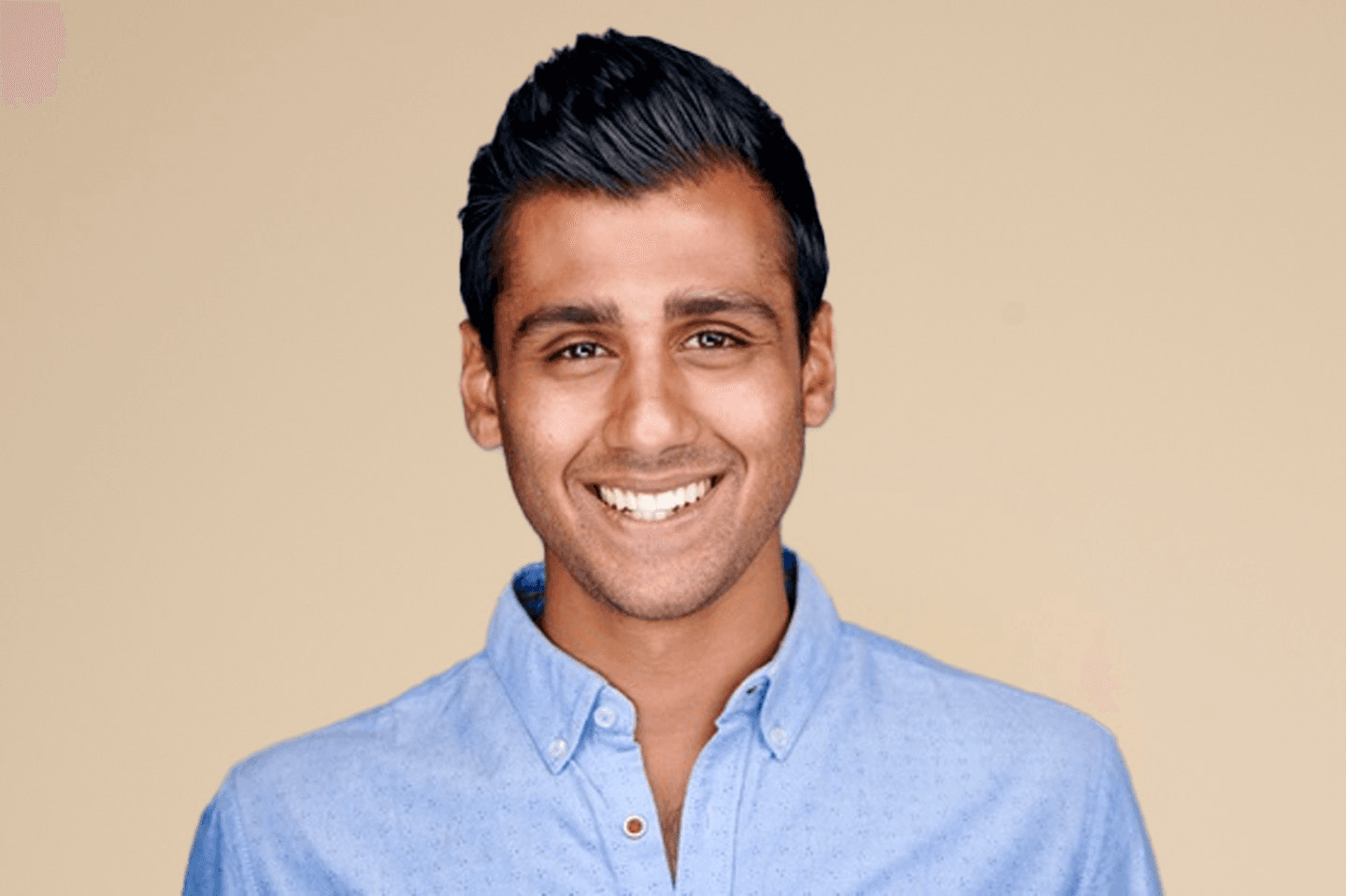

9. Shan Aggarwal - Coinbase Ventures

Shan joined Coinbase in 2018 and helped launch Coinbase Ventures and become one of the most active crypto investors. Coinbase has invested in over 300 firms and is emulated by all their competitors like Kraken, Binance, Crypto.com, and Blockchain.com, who have all launched their own venture arms.

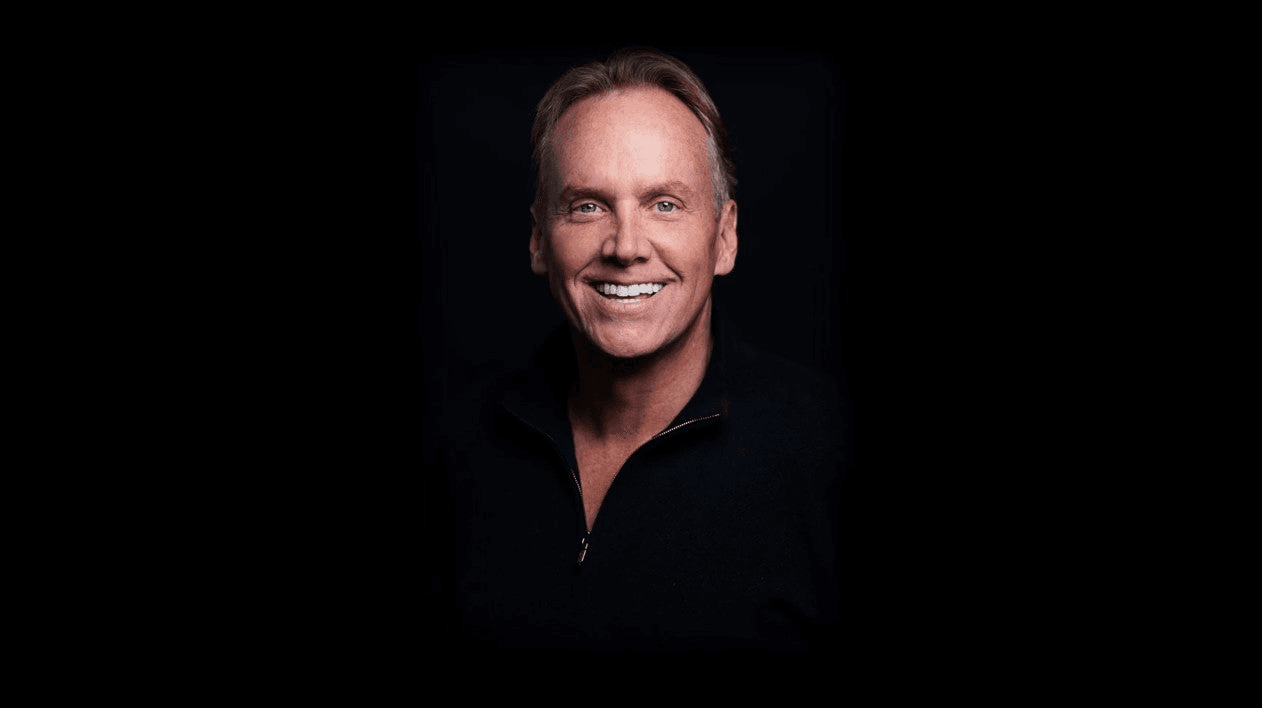

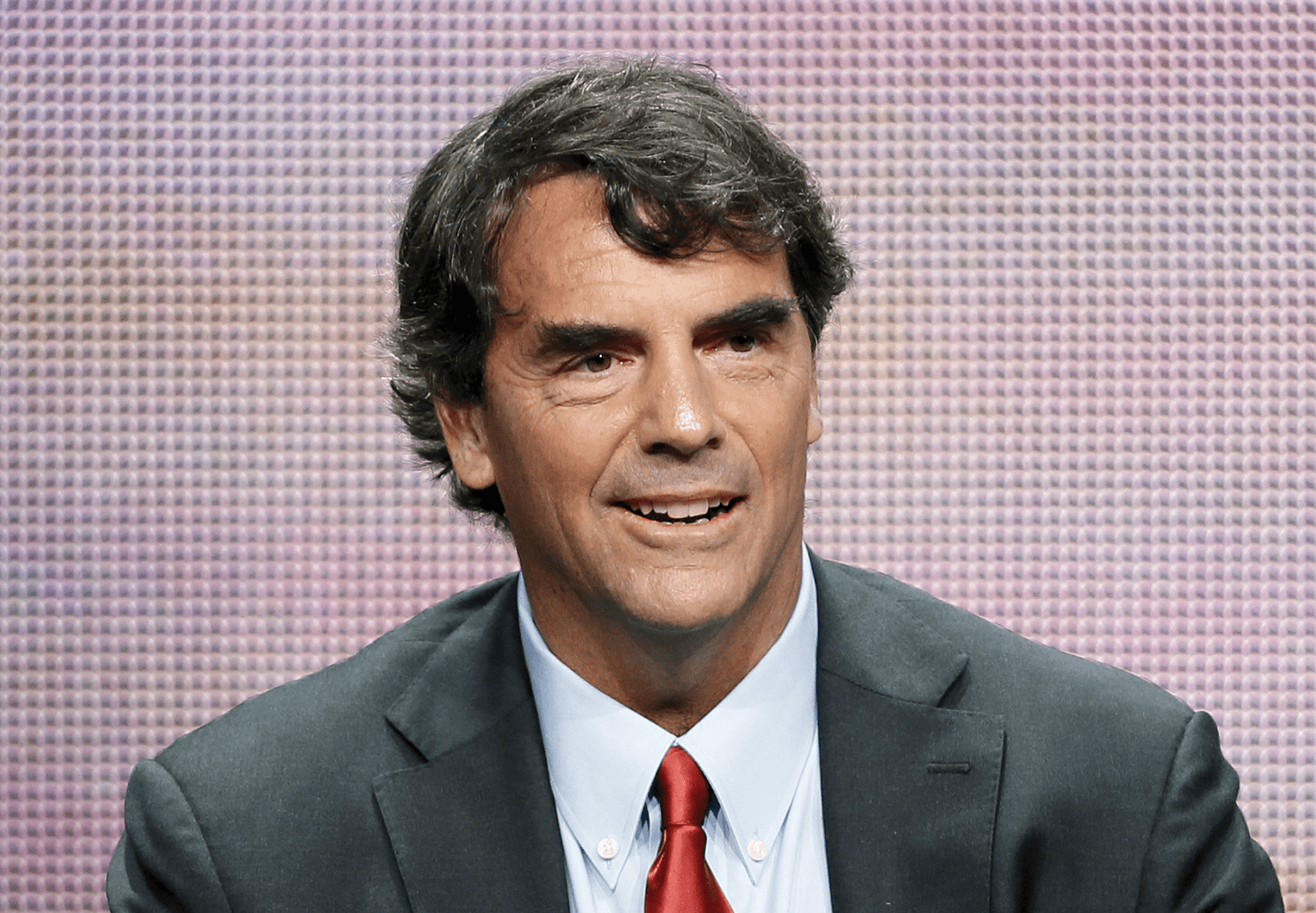

10. Tim Draper - Draper Associates

Tim Draper is one of the most famous silicon valley venture capitalists as his firm DFJ was an early investor in Skype, Hotmail, SpaceXand Tesla. Tim’s son, Adam, started Boost VC in 2012 and started investing in crypto companies, and got his father, Tim, involved as well. Adam and Tim were both early investors in Coinbase, but Tim became famous in crypto in 2014 when he purchased 29,656 Bitcoins from the US Marshalls at $640 per Bitcoin. These Bitcoins were seized by the government in the Silk Road case. Tim Spent around $19M to purchase the Bitcoins and got a lot of bad press as the price of Bitcoin crashed shortly after to $200. However, Tim didn’t get discouraged and believed Bitcoin would rebound, and those Bitcoins have been worth as much as $1.8B. To the moon, Tim.

That's all, folks. If you enjoyed this article, check out our other Top10 piece on the biggest crypto arrests of all time!

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X