Top 10 Biggest Crypto Arrests That Shook the Industry

By Pratik Bhuyan Updated January 14, 2026

Crypto was built on the promise of decentralization, freedom, and trustless systems. But as the industry grew, so did the scale of greed, fraud, and regulatory crackdowns. Over the last decade, several high-profile arrests and convictions did more than send individuals to court or prison. They permanently altered how the world views crypto.

From darknet marketplaces to billion-dollar exchange collapses, these are the 10 biggest crypto arrests that sent shockwaves across the industry.

1. Sam Bankman-Fried

The fall of crypto’s golden boy

Why he was arrested:

Bank fraud, wire fraud, securities fraud, conspiracy.

Scope of the scandal:

Over $8 billion in customer funds misused through FTX and Alameda Research.

Impact and Aftermath:

SBF went from being the poster child of “responsible crypto” to its most infamous villain. Once praised on Capitol Hill and featured alongside global leaders, he was arrested after FTX collapsed almost overnight. Currently, he’s serving a 25-year federal prison sentence.

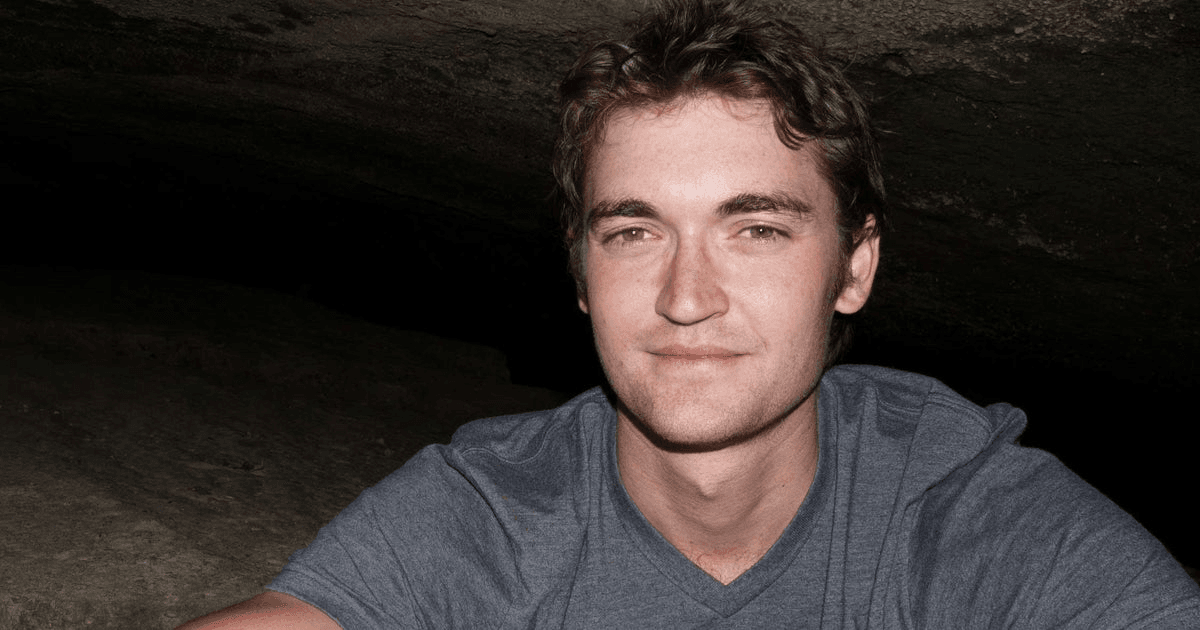

2. Ross Ulbricht

The darknet kingpin who brought Bitcoin global attention

Why he was arrested:

Operating an illegal marketplace, money laundering, conspiracy.

Scope of the operation:

Silk Road facilitated over $1 billion in illicit transactions using Bitcoin.

Impact and Aftermath:

Ross Ulbricht’s Silk Road proved, for the first time, that Bitcoin could function as censorship-resistant money. He was sentenced to 40 years in prison in 2015, but served 11 years before getting a presidential pardon by Trump in 2025.

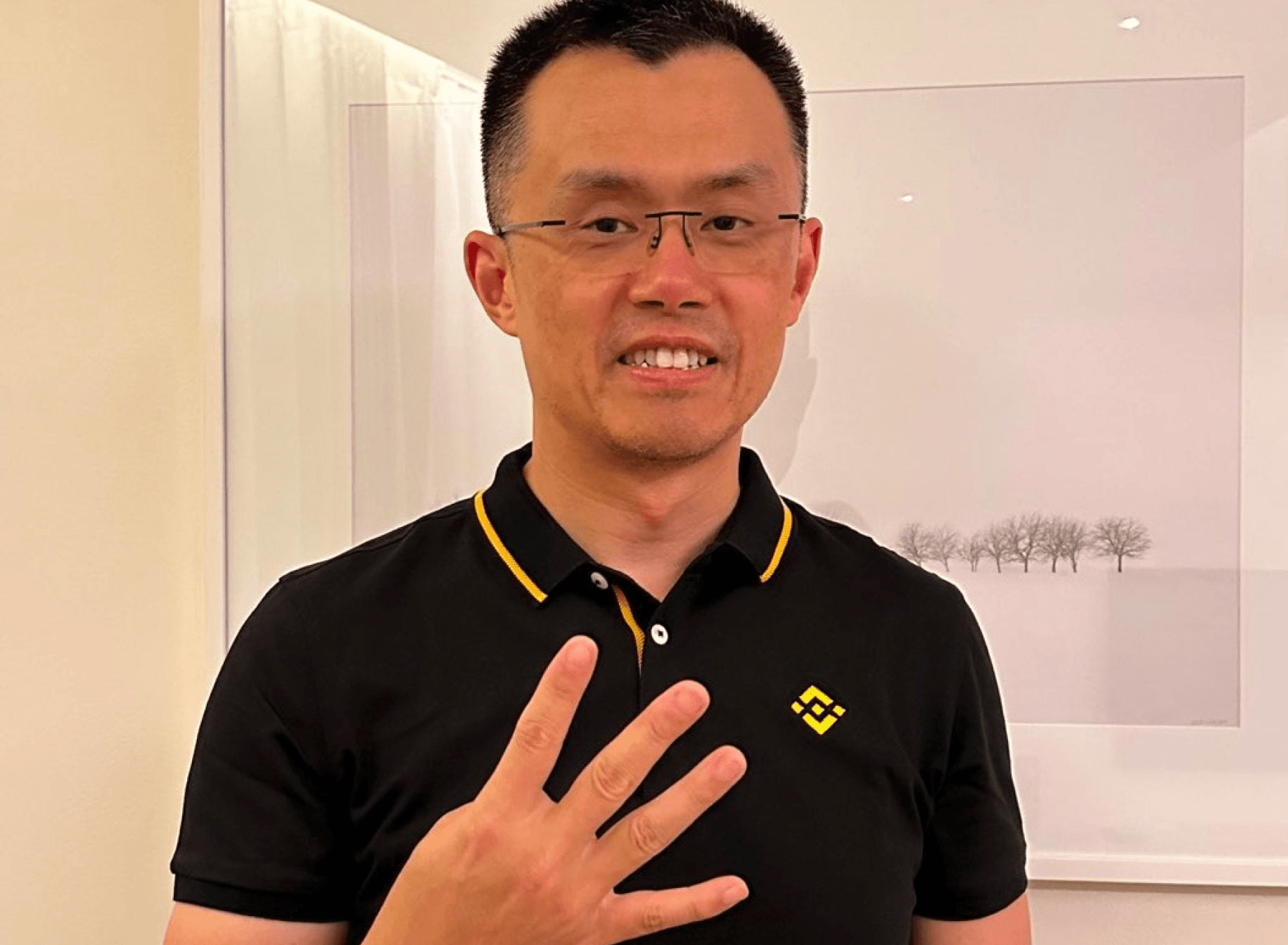

3. Changpeng Zhao

When the biggest exchange met U.S. law

Why he was arrested:

Violations of anti-money laundering and sanctions laws.

Scope of the case:

Binance agreed to pay over $4 billion in penalties.

Impact and Aftermath:

CZ’s arrest shocked the industry because Binance was seen as too big to fall. But, funny thing, CZ’s signature four-finger “ignore FUD” gesture ended up matching the four-month prison sentence he ultimately received!

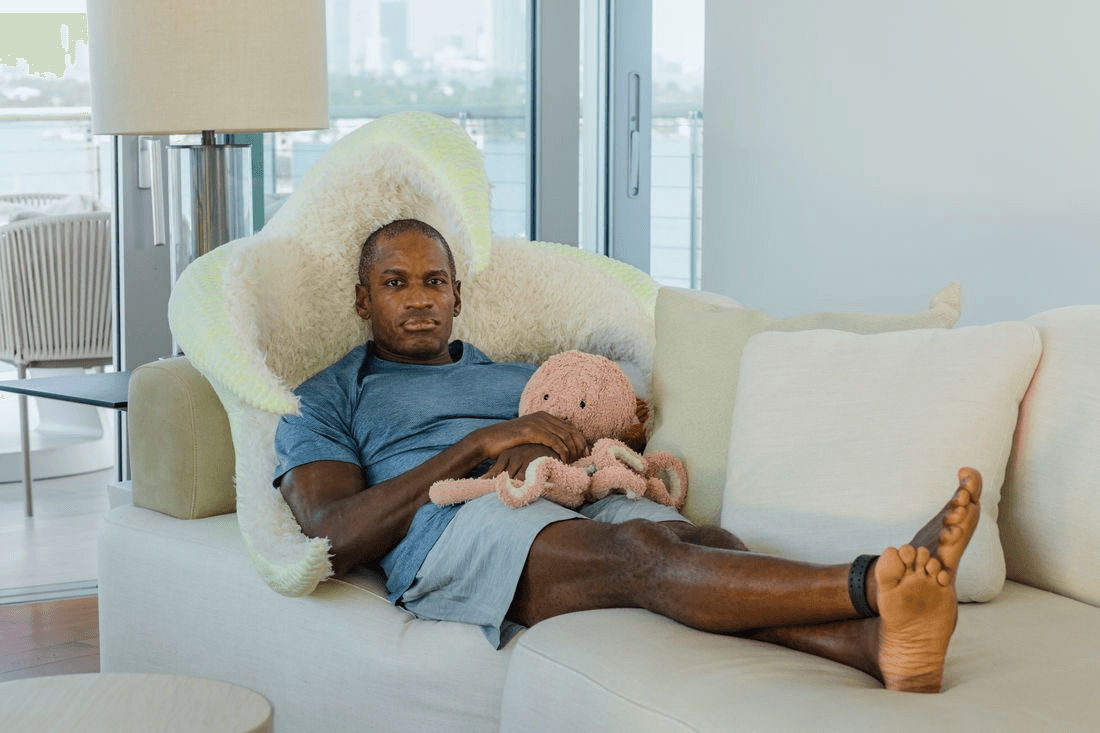

4. Do Kwon

The collapse that erased $60 billion

Why he was arrested:

Fraud, misleading investors, securities violations.

Scope of the damage:

Terra Luna and UST collapse wiped out tens of billions in market value.

Impact and Aftermath:

Do Kwon’s algorithmic stablecoin experiment was marketed as revolutionary. When it failed, the contagion nearly took the entire crypto market down with it. He has been sentenced to 15 years of prison time.

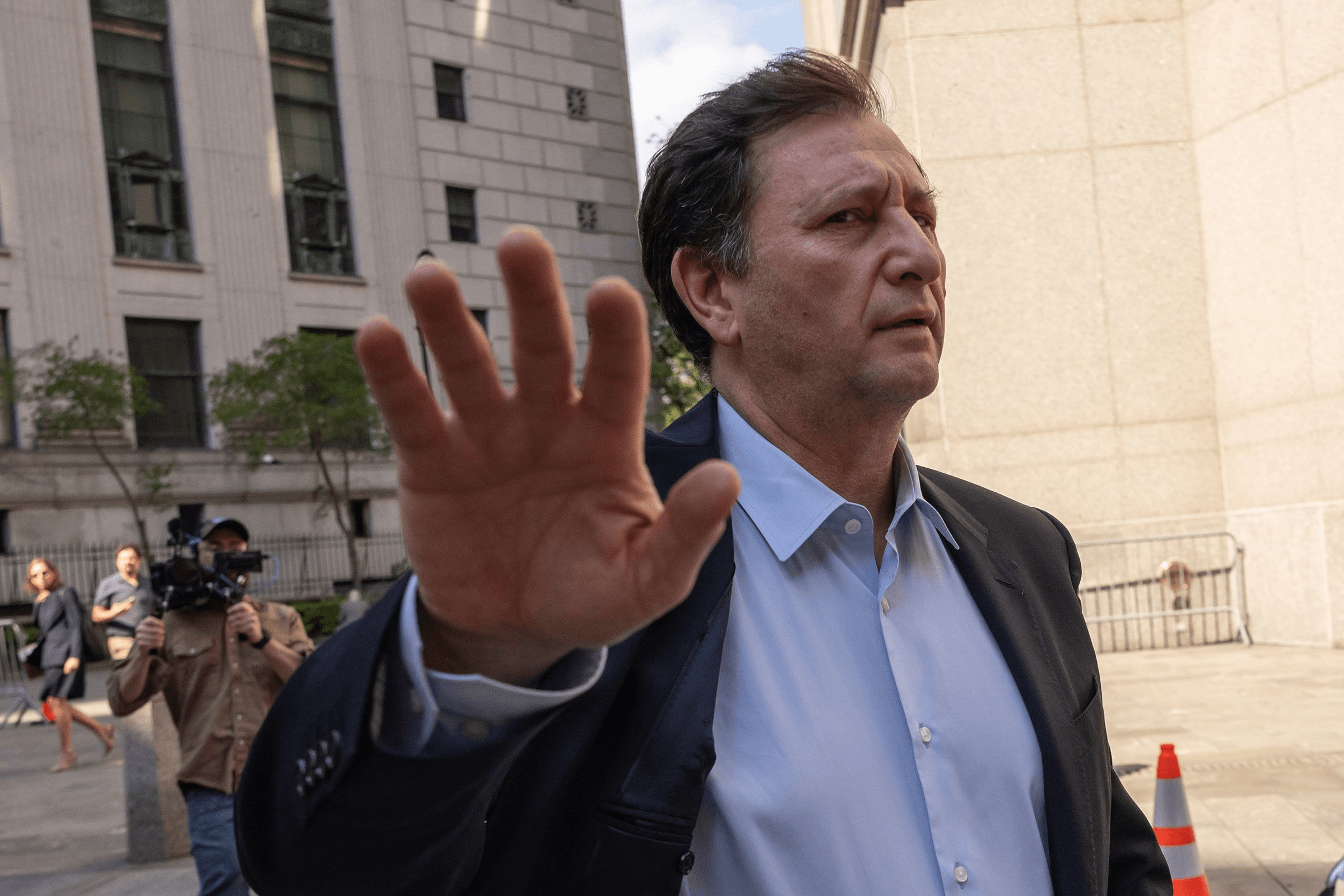

5. Alex Mashinsky

“Unbank yourself” until withdrawals froze

Why he was arrested:

Fraud, misrepresentation, market manipulation.

Scope of the scandal:

Celsius controlled over $25 billion in user assets at its peak.

Impact and Aftermath:

Mashinsky promised safety, yield, and transparency. Behind the scenes, Celsius was engaging in risky strategies while publicly claiming otherwise. The 60-year-old has been sentenced to 12 years in federal prison.

6. Arthur Hayes

The derivatives boom meets regulators

Why he was arrested:

Failure to implement AML and KYC procedures.

Scope of the case:

BitMEX once handled billions in daily trading volume.

Impact and Aftermath:

Arthur’s case established that crypto derivatives platforms cannot operate outside regulatory frameworks simply because they are offshore. He was sentenced to 6 months of home confinement and 2 years of probation, and was later pardoned in March 2025 by President Trump.

7. Charlie Shrem

An early warning the industry ignored

Why he was arrested: Aiding and abetting money laundering.

Scope of involvement:

Indirect facilitation of Silk Road transactions.

Impact and Aftermath:

Charlie Shrem was one of Bitcoin’s earliest evangelists. His arrest showed that even indirect involvement in illicit flows could lead to jail time. He was released in 2016 after serving a little over a year of his sentence.

8. Mark Karpelès

The exchange collapse that started it all

Why he was arrested:

Data manipulation and breach of trust.

Scope of the failure:

Over 850,000 BTC lost or stolen.

Impact and Aftermath:

Mt. Gox handled the majority of Bitcoin trading volume at its peak. Its collapse set the tone for exchange security, custody practices, and proof-of-reserves discussions that continue today. Mark received a 2.5-year prison sentence, suspended for 4 years in Japan.

9. Michael Patryn

Crypto’s most mysterious exchange saga

Why he was arrested:

Fraud and financial crimes linked to QuadrigaCX.

Scope of the scandal:

Over $190 million in user funds vanished.

Impact and Aftermath:

Already known for a criminal past, Patryn’s involvement in QuadrigaCX added another layer of distrust to centralized exchanges. The case remains one of the strangest in crypto history, filled with unanswered questions.

10. Heather Morgan

The Bitfinex hack that turned into a pop-culture spectacle

Why she was arrested:

Conspiracy to launder stolen Bitcoin linked to the 2016 Bitfinex hack.

Scope of the operation:

Roughly 120,000 BTC moved through complex chains of wallets, exchanges, and darknet services over several years.

Impact and Aftermath:

Known publicly for her eccentric online persona, her exposé was a stark reminder that not all crypto conspirators are founders or coders; at times, a rapper with no taste for music. Morgan was sentenced to 18 months in prison and 3 years of supervised release.

If you enjoyed this article, check out our other Top 10 piece on the top crypto predictions for 2026!

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X