Why Polygon Is the Leader in Crypto Payments

By Pratik Bhuyan Updated February 2, 2026

Summary

- Stablecoins have evolved into the core payments layer of crypto and Polygon has emerged as a leading network due to sustained real world usage rather than short term hype.

- Polygon’s dominance in USDC activity driven by cheap fast transactions and billions of transfers shows it is being used for everyday payments & remittances at scale.

- Applications like Polymarket and integrations with Stripe and Revolut prove that users and major fintechs actively rely on Polygon to settle real economic outcomes using stablecoins.

The One Use Case Crypto Got Right

The crypto market runs on narratives and every year, a new theme takes over the market. One year it is NFTs, another year it is memecoins & sometimes it is privacy or gaming. But through all these cycles, payments have been the narrative everyone has been talking about.

While trends come and go, crypto payments, particularly stablecoins, have only grown bigger. In 2026, stablecoins are no longer just a place to park funds during volatility. Today, they are being used for payments, remittances, trading, and everyday transactions. As more real money starts moving onchain, stablecoins are becoming the most important layer in crypto.

That shift made us look deeper. If stablecoins are powering the next phase of adoption, which blockchain is actually leading this growth? When you follow the data, the partnerships, and the real usage, one network stands out: Polygon.

USDC Activity on Polygon Keeps Growing

One of the biggest reasons Polygon leads in payments is its dominance in USDC usage. USDC is the most trusted stablecoin for real world transactions, and Polygon has quietly become one of its busiest networks.

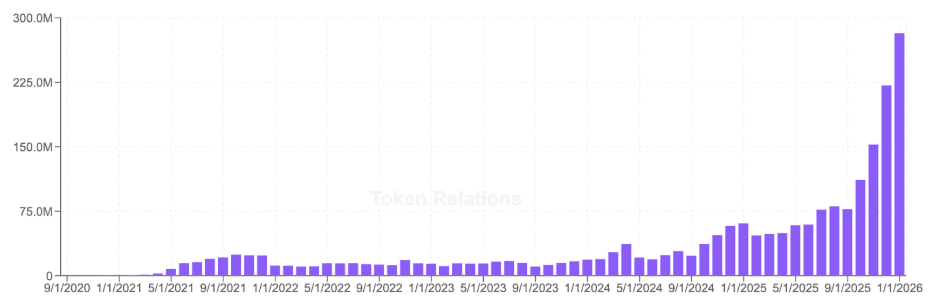

In 2025, Polygon recorded nearly 58 million wallets interacting with USDC, including over 3 million new addresses in December alone. Over the full year, Polygon handled about 1.4 billion stablecoin transfers, up more than 200% from the year before, and USDC supply on the chain grew strongly with nearly $2.83 billion in stablecoin assets by year end.

More recently, January 2026 marked a breakout month for stablecoin activity on Polygon. The network processed 282.1 million stablecoin transfers, up 28% from December, setting a new monthly record. This marked the fourth consecutive month of all-time highs for stablecoin activity. USDC led the surge, reaching a record transfer count and moving $20.8 billion during the month. USDT followed with $6 billion, while DAI accounted for $3 billion, bringing total stablecoin volume on Polygon to $29.8 billion.

What stands out is the consistency behind these numbers. USDC supply on Polygon grew 84% year over year to $1.43 billion, while active stablecoin addresses reached 2.1 million. This growth reflects how Polygon’s ecosystem is increasingly centered around payments and real economic activity. As stablecoins are used more frequently for transactions, prediction markets, and onchain commerce, Polygon continues to strengthen its role as a network optimized for high-volume, real-world value transfer.

But Why is USDC Activity Exploding on Polygon?

Users prefer Polygon because transactions are cheap and fast, which matters when people are sending money, paying for services, or moving funds frequently. A large share of stablecoin transfers on Polygon are everyday-sized payments, not just large DeFi movements. This shows that Polygon is being used as a payment rail, not just a smart contract platform.

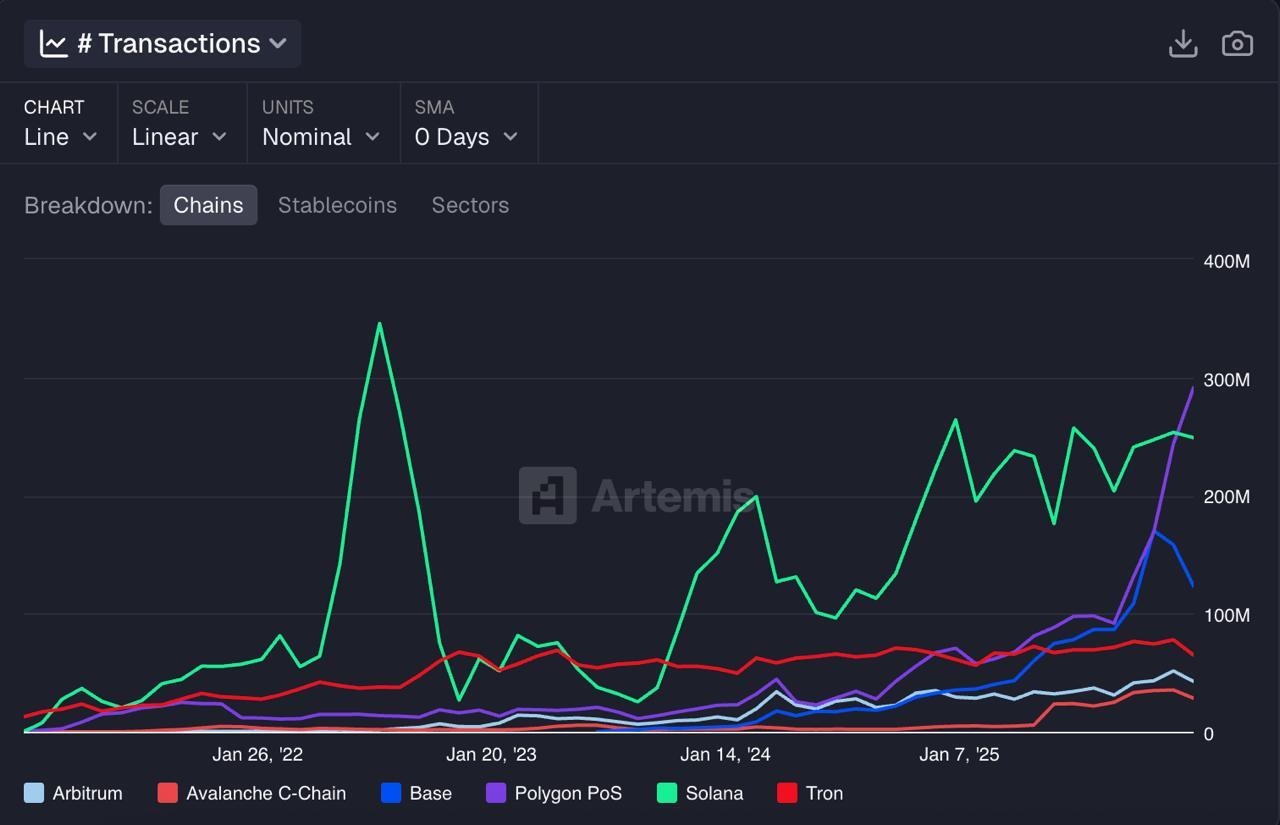

The transaction data highlights a clear shift in how Polygon has grown relative to other major chains. While some networks show sharp spikes followed by periods of decline, Polygon’s transaction activity increases more gradually over time. Through 2025, Polygon has already been processing a meaningful share of total transactions, signalling steady adoption rather than short-lived bursts of activity.

What makes this growth notable is the context behind it. The rise in transactions aligns with increased stablecoin usage, consumer-facing applications, and fintech integrations that rely on frequent, low-cost transfers. As stablecoin adoption grows, networks that support high-volume and low cost transfers naturally pull ahead. Polygon has already crossed that threshold.

Polymarket Shows Real Payment Demand

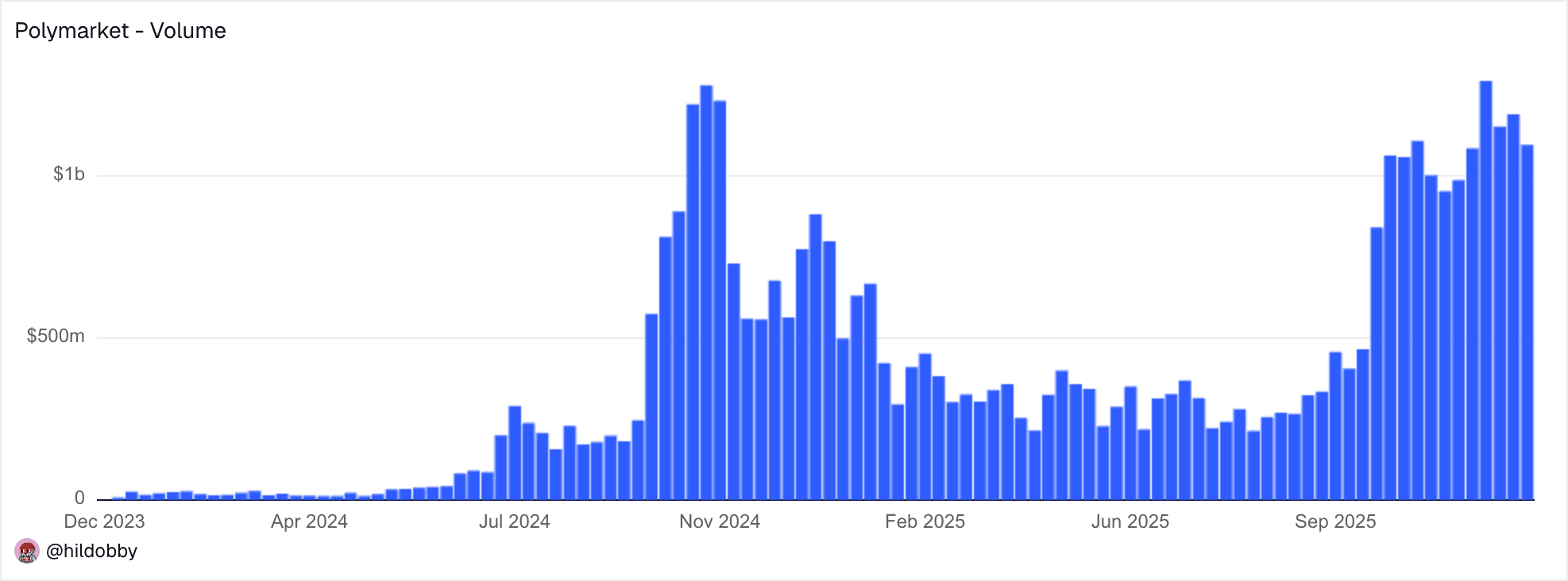

Another major signal comes from Polymarket. The popular prediction market runs on Polygon and uses USDC for all activity. Every trade, payout, and settlement happens on the network.

Last year, Polymarket saw over $26.8 billion in trades, with every transaction settled in USDC on Polygon. This matters because it proves people are actively using stablecoins on Polygon for real outcomes, not just holding them.

Over the course of the year, Polymarket consistently held more TVL than every other prediction market combined, finishing with a dominant 65% share of total prediction market TVL on Polygon. When users trust a network with funds tied to real-world events, it strengthens Polygon’s position as a reliable payments layer.

Strong Fintech Partnerships With Stripe and Revolut

Polygon’s role in crypto payments goes beyond native crypto apps. It has secured partnerships with major fintech players that already serve millions of users.

Revolut integrated Polygon to allow stablecoin transfers that are fast and cost-efficient. This brought crypto payments to users who may not even think of themselves as crypto native. The volumes processed through Polygon via Revolut highlight how well the network fits mainstream finance use cases.

Stripe is another key piece of the puzzle. By supporting stablecoin payments that settle on Polygon, Stripe enables merchants to accept crypto in a familiar way. This bridges the gap between traditional online payments and blockchain based settlement, with Polygon acting as the underlying infrastructure.

Acquisitions That Unlock Legal Payments in the US

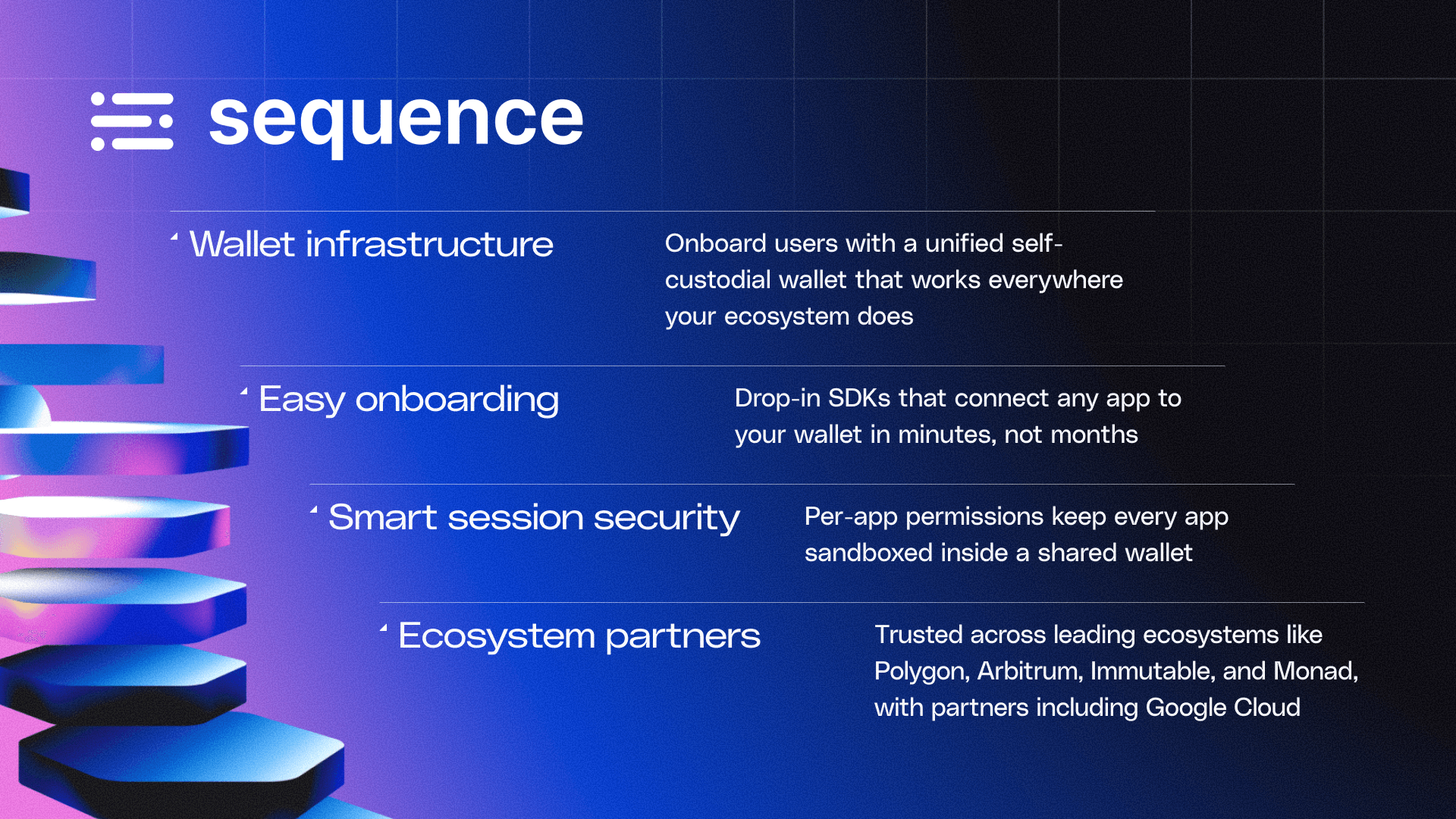

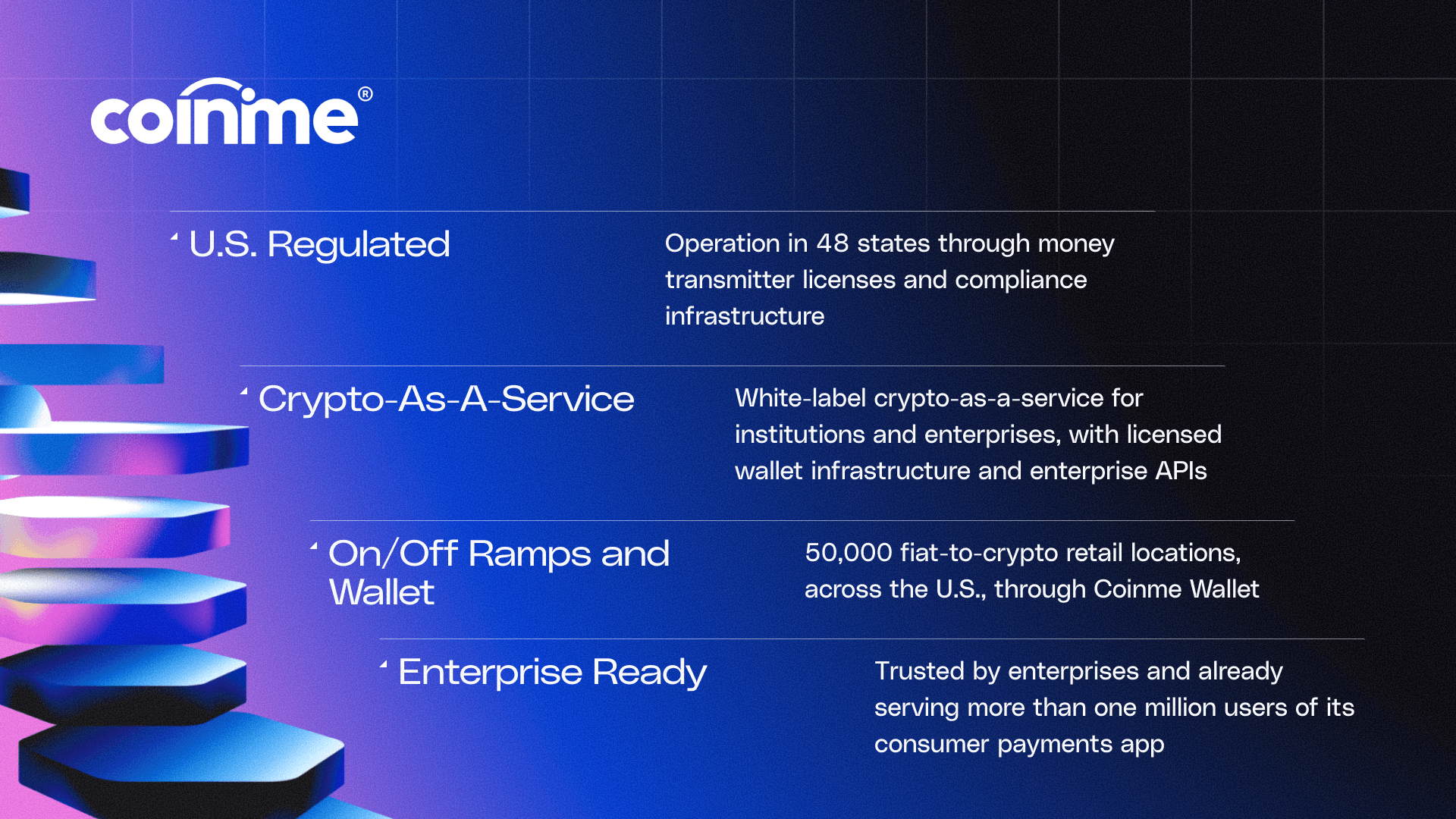

Polygon recently made one of its most important moves yet by stepping directly into regulated payments through the acquisitions of Sequence and Coinme. These acquisitions gave Polygon access to wallet infrastructure, on-ramps and off-ramps, and most importantly, licensed payment rails in the United States.

Sequence gives Polygon an advanced wallet infrastructure that removes friction for users and developers. It makes stablecoin payments feel seamless, whether someone is paying, receiving funds, or interacting with an app.

Coinme adds something even more critical. It brings licensed fiat on-ramps and off-ramps across most US states, along with the regulatory approvals needed to move money legally between crypto and the traditional financial system.

With these licenses in place, Polygon is no longer dependent on third parties to handle compliance. It can now support stablecoin payments that meet US regulatory standards at scale. That changes everything. For merchants, fintech apps, and payment companies, this means that Polygon is not just fast and cheap; it is now also compliant and reliable.

The Bigger Picture

When you step back, Polygon’s lead in crypto payments becomes clear through sustained network usage rather than isolated features or headline partnerships. Large volumes of USDC move across the network every day. Consumer-facing apps like Polymarket settle real value onchain. Fintech integrations continue to expand, alongside a steady push toward compliant payment infrastructure. Together, these signals point to the same conclusion. Polygon functions as an active payments network, supporting real economic activity at scale.

This level of usage directly strengthens the Polygon ecosystem. Every stablecoin transfer, payment flow, and onchain interaction runs on Polygon’s infrastructure and is secured by the network. As activity grows, the role of their POL token grows with it, supporting network security, staking participation and long-term sustainability.

There’s no doubt that stablecoins are becoming the default way money moves onchain. And not just for speculation, but also for paying, settling, and transferring value across borders. Polygon seems to understand that better than most. Instead of positioning itself as the future of payments, it is behaving like payments are already here. And in many ways, they are. If you look at where stablecoins are actually being used today, Polygon keeps showing up at the center of that flow.

If you enjoyed this article and want to learn more about what Polygon is building, follow them on X for the latest updates.

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X