Why Lit Protocol's LITKEY Launch Deserves Attention

By Will McKinnon Updated October 30, 2025

Summary

- Lit Protocol is a decentralized key management network that solves one of Web3’s fundamental problems: how to enable secure, programmable control over digital assets and data without relying on centralized custodians.

- They currently support over 150 ecosystem teams building across everything from cross-chain bridges to digital identity systems.

- The tokenomics structure ties emissions directly to network revenue through the veLITKEY model, further aligning community success with protocol success beyond the initial distribution.

Introduction

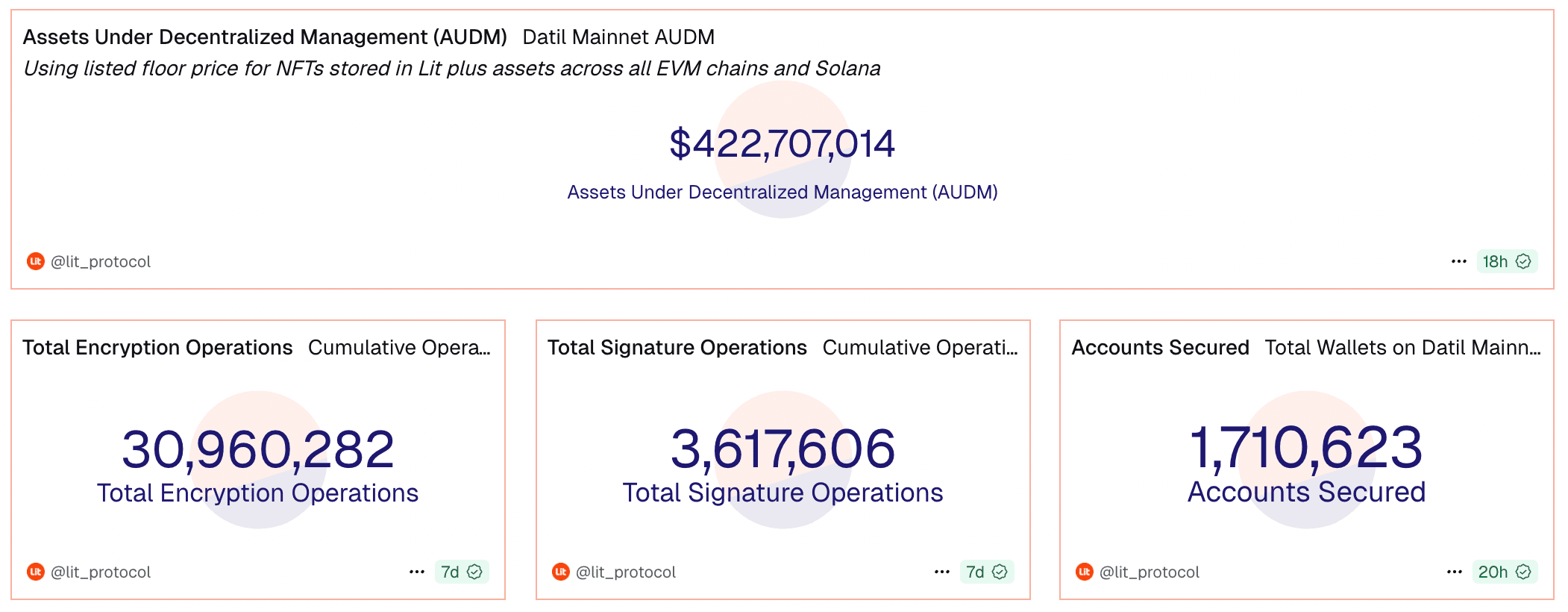

After five years of development and over a year of mainnet operation, Lit Protocol has launched its native LITKEY token on Aerodrome’s Ignition platform. What sets this launch apart is both what Lit Protocol has already accomplished and how they’ve chosen to bring LITKEY to market amidst the highly extractive launches we’ve seen out of several altcoins this year. While most crypto projects launch tokens before building real products, Lit Protocol is going the opposite way. Their network is already responsible for securing over $400M in assets for partners like Emblem Vault and has processed tens of millions of encryption operations. Now with LITKEY, the community has an opportunity to participate in a project that’s already proven its value.

The launch on Aerodrome Ignition reflects Lit Protocol’s commitment to transparent, community-driven distributions. Rather than predetermined valuations made in private with VC funds, price discovery will happen onchain through the community. For Aerodrome users who hold veAERO voting rights, this launch offers access to a promising infrastructure project at the intersection of crypto and AI.

What Sets Lit Protocol Apart

Lit Protocol is a decentralized key management network that solves one of Web3’s fundamental problems: how to enable secure, programmable control over digital assets and data without relying on centralized custodians. The network uses threshold cryptography and secure enclaves to split private keys across multiple nodes, meaning no single entity ever controls complete access to user funds or data.

Their tech stack enables three core capabilities. First, decentralized signing allows applications to generate signatures for transactions without exposing private keys. Second, programmable encryption lets developers control who can decrypt specific data and under what conditions. Third, secure compute operations enable private calculations on sensitive information. These capabilities power applications across multiple verticals, resulting in their current support for over 150 ecosystem teams building across everything from cross-chain bridges to digital identity systems. Their signing requests are growing at a rate of 45% per month, a clear signal of product-market fit that most tokens lack on launch.

Vincent, Lit’s recently launched DeFi automation platform, demonstrates the protocol’s real-world utility. As covered in our previous article, Vincent enables autonomous AI agents that can manage DeFi positions without requiring users to surrender custody of their funds. Their platform is already delivering compelling yields by optimizing positions on Morpho, delivering up to 10% APY in USDC. While this is exciting, what makes Lit Protocol particularly compelling is its potential scope beyond DeFi. The same infrastructure powering Vincent’s automated trading agents can enable secure automation across traditional finance, SaaS applications, and social media operations. Workflows that require credentials can be delegated to agents with user-defined guardrails and instant revocation capabilities if needed.

Understanding the Launch Mechanics

Aerodrome Ignition represents a different approach to token launches, prioritizing community participation over closed-door funding rounds. The mechanism is straightforward but powerful in its distribution capabilities. Lit Protocol deposited 10 million tokens (1% of the total LITKEY supply) into the Ignition launch pool, which are available to users who hold veAERO (earned for locking AERO tokens on Aerodrome). The longer users lock their AERO, the more veAERO voting power they receive. In theory this means the LITKEY sale will see a higher quantity of quality holders than the average fully-public ICO, as anyone participating has a vested interest in seeing Aerodrome launches succeed.

For a project like Lit Protocol that has already found significant traction, this approach makes a lot of sense. Transparent price discovery will reflect genuine market demand rather than speculative hype driven by marketing. The community involvement in initial pricing aligns perfectly with Lit’s broader commitment to decentralization and user control.

Tokenomics and Utility

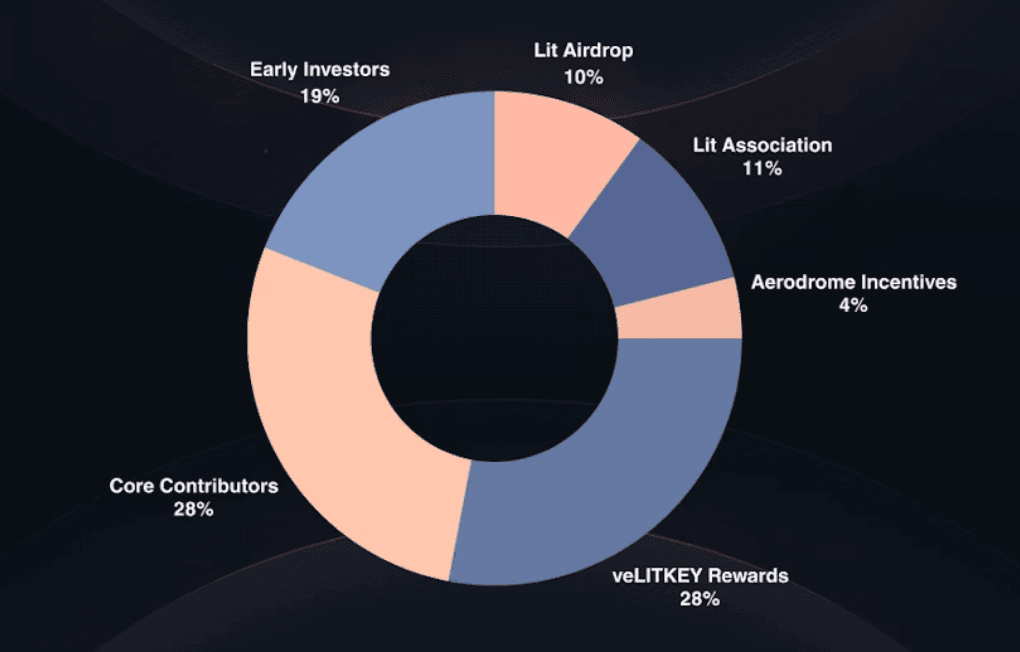

LITKEY has a capped supply of 1 billion tokens, with 22% circulating on TGE. About half of this is distributed through the airdrop, CEX listings, and Aerodrome Ignition, with the remainder belonging to the foundation for liquidity incentives and other operations.

The token serves three distinct functions within the Lit Protocol ecosystem. First, node operators must stake LITKEY to participate in the network’s operations. The amount staked and the duration of the timelock affect reward rates, creating strong incentives for long-term commitment and reliable performance. As a payment token, LITKEY is used to pay for the network’s core services, including signing operations, encryption requests, and compute tasks just as you would use ETH to pay for transactions on Ethereum. As a governance token, LITKEY can be locked to receive veLITKEY, which grants time-weighted voting rights. Holders influence crucial protocol decisions including node operator selection, ecosystem, partnerships, network expansion, and the direction of builder incentive programs.

The tokenomics structure ties emissions directly to network revenue through the veLITKEY model, further aligning community success with protocol success beyond the initial distribution. As the protocol generates more revenue, token emissions scale proportionally until the supply cap is reached. This creates a sustainable economic model where rewards track actual network value creation.

Wrapping Up

The LITKEY launch on Aerodrome demonstrates how established projects with real traction can bring tokens to market in ways that prioritize community participation over the “low float high FDV” extraction schemes that have become popular. The combination of real utility, proven traction, and fair distribution creates a compelling opportunity. Lit Protocol has built essential infrastructure for the autonomous future of crypto, while also baking the proper incentive alignment into their tokenomics and initial distribution. The launch timing also lines up with a major network upgrade, Lit’s v1 mainnet Naga, which introduces staking-based validator selection, usage-based payments, expanded cryptographic support, and much more.

For more information on Lit Protocol, the LITKEY token launch, and the upcoming Naga mainnet, check out their X. To get started building on Lit Protocol, visit their website here.

Disclaimer: Beluga has a marketing partnership with Lit Protocol

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X