ICOs Are Back, Here’s How to Invest Safer in 2026

By Pratik Bhuyan Updated December 29, 2025

Summary

- ICOs staged a quiet comeback in 2025 and the momentum shows little sign of slowing, as clearer regulation, political tailwinds, and a more mature market encourage an increasing number of projects to return to this fundraising route.

- Recent ICO outcomes show that projects with real products, transparent token models, and consistent execution outperform hype driven launches that rely on narratives, nostalgia, or shifting roadmaps.

- Vesting terms should be treated as a core risk factor since teams can and do change unlock schedules after sales, meaning paper gains are never guaranteed until liquidity is realized.

Introduction

Back in 2017, ICOs felt unstoppable. Whitepapers raised millions overnight, Telegram groups exploded with hype, and early investors genuinely believed they were funding the next Ethereum. Then came the crashes, scams, and regulatory crackdowns. For years, ICOs were treated like a dirty word.

Fast forward to 2025 and 2026, and ICOs are quietly making a comeback.

This time, the revival looks different. Investors are more cautious, teams are more polished, and the market has learned some hard lessons. A big catalyst behind this renewed confidence has been the openly pro-crypto stance of Donald Trump and his broader political alignment with the industry. Clearer regulatory expectations in the US, combined with institutional comfort around crypto, have made early stage token launches feel investable again rather than radioactive.

But make no mistake. ICOs are still risky. The difference now is that investors have better tools and better instincts. That is exactly what this guide is about.

What Are ICOs?

An Initial Coin Offering, or ICO, is basically how crypto projects raise money at a very early stage. Instead of selling company shares, teams sell digital tokens to early believers. These tokens might later be used inside the product, for voting on decisions, or simply as the fuel that powers the network. For investors, ICOs offer a chance to get in early, often before a token hits exchanges and public hype kicks in. The catch is simple. You are betting on potential, not a finished business.

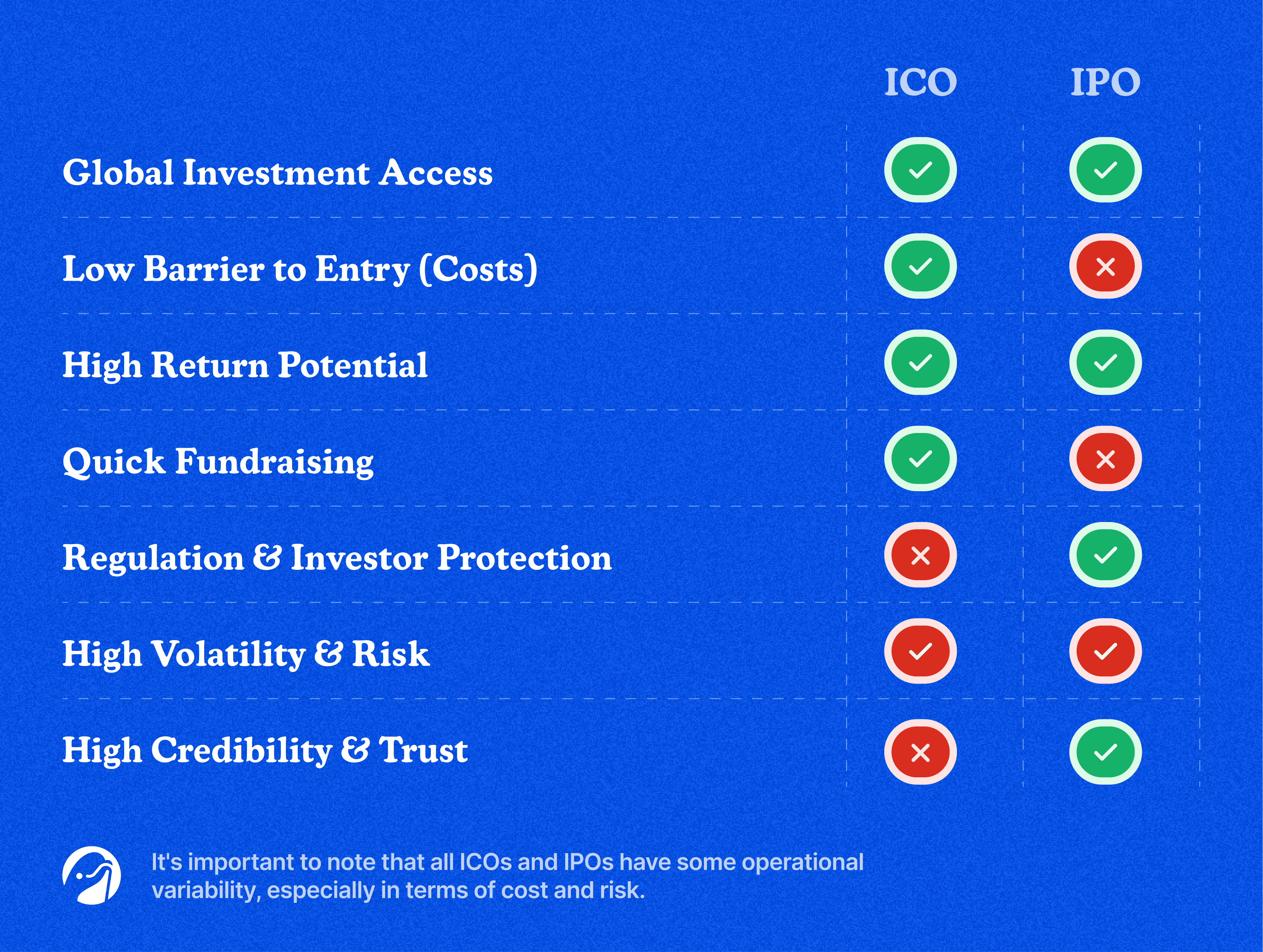

How Are They Different From IPOs?

Unlike an IPO, an ICO does not represent ownership in a company. Buying tokens does not give you equity, dividends, or shareholder rights. ICOs are usually faster, global, and far less regulated than stock market listings. IPOs involve established companies with audited numbers. ICOs fund ideas that are still taking shape. That gap is where both the risk and the opportunity come from.

Why ICOs Are Back on the Radar

Well, honestly, the modern ICO resurgence did take its own sweet time; it did not happen overnight. Several factors lined up:

First, regulation became less chaotic. While crypto is still far from perfectly regulated, the era of sudden blanket bans and unclear enforcement has eased. Projects now structure token sales with more legal foresight, often excluding certain jurisdictions or using compliance layers.

Second, market maturity played a role. After DeFi summers, NFT booms, and multiple bear cycles, capital is no longer chasing every shiny pitch deck. Investors want real products, real users, and realistic token models.

Finally, political tailwinds matter. When a major political figure like Donald Trump publicly supports crypto innovation, it changes how founders, funds, and even retail investors perceive risk. Confidence flows downstream.

The 2025 ICO Class: Winners and Letdowns

Not every recent ICO has played out the same way. A few genuinely rewarded patient investors, while others served as a reminder of why healthy skepticism still matters.

ICOs That Lived Up to the Hype

A few 2025 launches managed to deliver both narrative and execution.

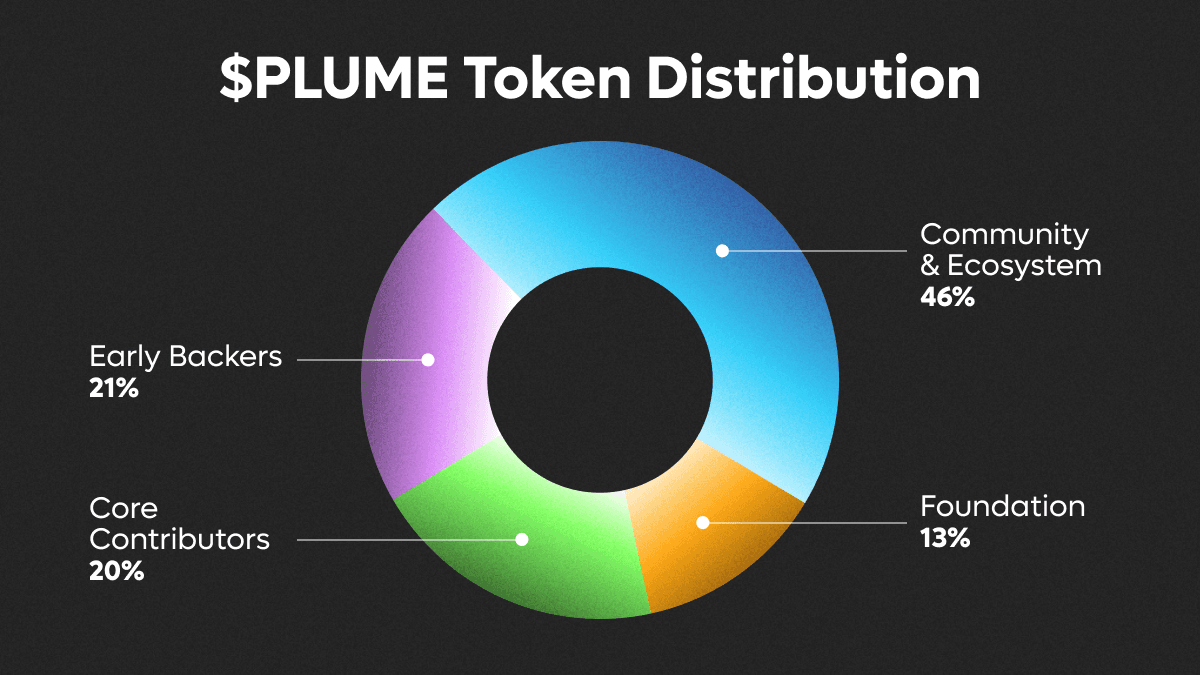

Projects like Plume Network, EigenLayer and infrastructure-focused launches attracted serious capital because they solved known problems rather than inventing new buzzwords. Token distributions were relatively transparent, products shipped on time, and post-launch communication stayed consistent.

Similarly, modular blockchain and AI adjacent protocols that launched with realistic valuations avoided the brutal post-listing dumps that defined earlier eras.

ICOs That Fell Short

On the flip side, several hyped sales underdelivered.

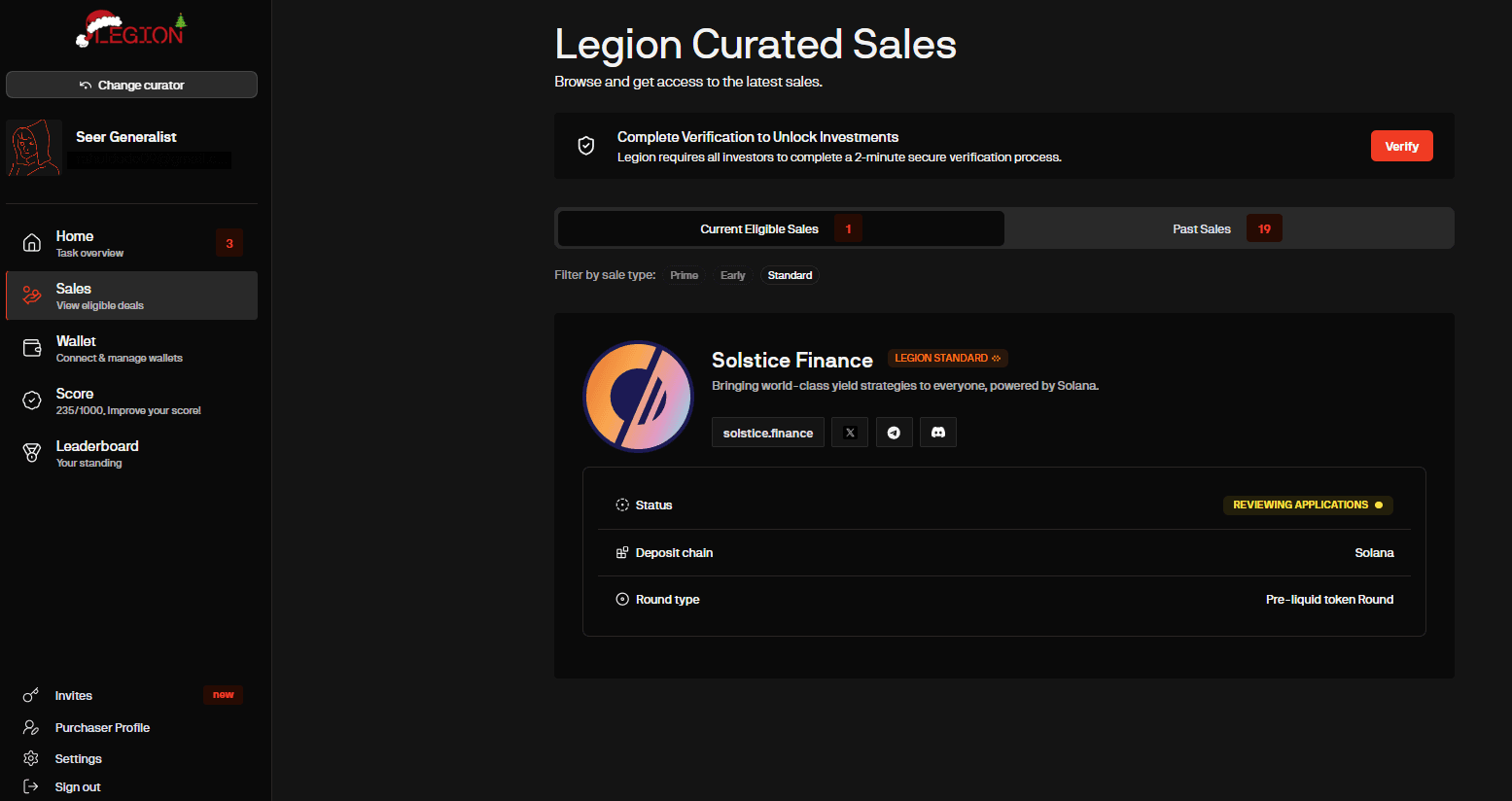

A particularly painful lesson came from the latest presale by Legion. As highlighted by market participants, vesting terms were changed after allocations were secured. The cliff moved from three months to nine months. For investors expecting liquidity sooner, this was a harsh reminder that token terms are not always as immutable as they appear.

Also, some gaming and metaverse ICOs raised aggressively on nostalgia and promises of mass adoption but struggled to retain users once incentives dried up. Others pivoted their roadmap multiple times within months of launch, leaving early investors unsure what they had actually backed.

The Uncomfortable Truth About ICO Terms

One of the most important lessons for 2026 investors is simple but uncomfortable.

Teams can change the rules.

Even if vesting schedules, cliffs, or unlocks are clearly stated during the sale, they are not always guaranteed in practice. Governance votes, foundation decisions, or legal restructuring can all alter timelines.

If your allocation does a 5x or 10x on paper, do not assume those gains are locked in. Sudden changes to vesting are not theoretical. They are already happening.

This does not mean all teams act in bad faith. It does mean you should assume flexibility exists unless proven otherwise.

Tips for Safer ICO Investing in 2026

ICOs can still be profitable, but only if you approach them with discipline rather than nostalgia.

1. Treat Vesting Like a Risk Factor, Not a Footnote

Most investors skim vesting schedules. In 2026, vesting deserves the same scrutiny as valuation.

Look for:

- Clear, contract enforced vesting rather than discretionary promises

- Onchain transparency around unlocks

- Public commitments from the team not to alter terms without token holder approval

If vesting can change easily, price that risk into your decision.

2. Prioritize Teams With Something to Lose

Anonymous teams are not automatically scams, but teams with reputations, prior exits, or public track records tend to behave more carefully.

Founders who have raised venture capital, operate visible companies, or are embedded in known ecosystems are less likely to torch their credibility for short term gains.

3. Beware of Narrative First ICOs

Strong storytelling is part of crypto, but narratives without shipping code rarely age well.

Before investing, ask:

- Is there a live product or testnet

- Are users interacting without heavy incentives

- Does the token have a clear role beyond speculation

If everything hinges on future adoption, you are funding hope, not progress.

4. Avoid Over Allocation No Matter How Convincing It Sounds

Even the best ICOs can underperform due to market conditions.

A safer approach is to treat ICOs as high-risk satellite bets rather than core portfolio holdings. Small, diversified allocations beat one oversized conviction trade.

5. Watch Post ICO Behavior Closely

The first three months after a token sale reveal more than any whitepaper.

Pay attention to:

- Communication frequency from the team

- Delivery against stated milestones

- Transparency around treasury usage

Silence or constant roadmap changes are early warning signs.

Final Thoughts

ICOs in 2026 are not the wild west of 2017, but they are not safe either. The comeback has been fueled by regulatory clarity, political support, and a more mature investor base. Yet the core risk remains unchanged. You are backing people before markets fully price them.

If you approach ICOs with healthy skepticism, realistic expectations, and respect for how quickly terms can shift, they can still offer asymmetric upside. Ignore those lessons, and history has a habit of repeating itself.

In crypto, the cycle always returns. The winners are simply better prepared the second time around.

Also, quick side note, if you’re keeping an eye on new token launches and launchpads, you might want to check out SuperWorld’s fundraising on the much-talked-about Bitstarter launchpad!

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X