Most People Get This Wrong: How Many Bitcoin Is Really Enough?

By Pratik Bhuyan Updated December 9, 2025

Summary

- How much BTC you should own depends entirely on whether you want simple exposure, portfolio diversification, long-term conviction, or high-risk wealth transformation.

- The current market pullback combines elevated fear with unchanged fundamentals, making gradual accumulation more rational than chasing price peaks.

- A balanced approach focuses on position sizing as a percentage of overall wealth rather than chasing a specific coin count seen on social media.

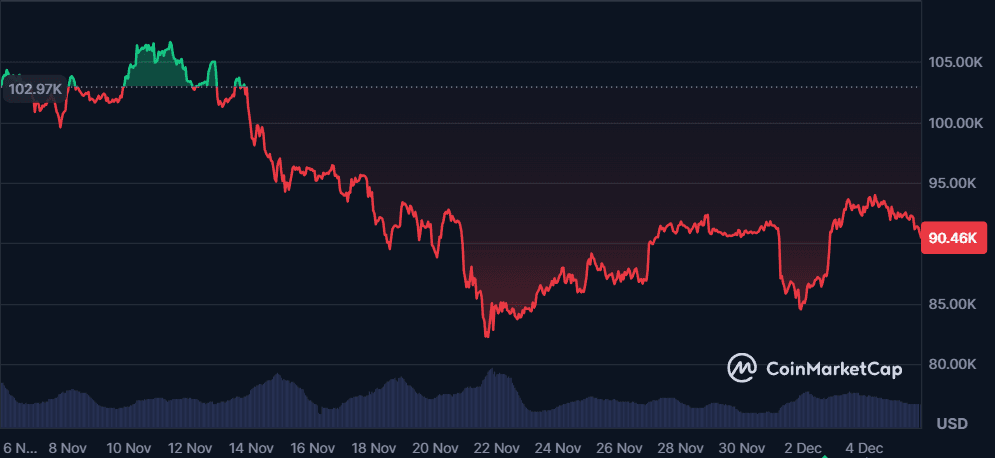

Bitcoin is back in the headlines because the price has pulled back sharply from its October peak. That makes this a good moment to ask a simple but important question: how much Bitcoin should you realistically aim to own over time? Below, I use clear frameworks and real-world numbers to show how you can think about sizing a BTC position in a way that is both sensible and sustainable.

Quick snapshot of the current landscape

Bitcoin has pulled back more than 30% from its highs, and while that drop looks scary on the surface, it has opened a cleaner entry zone for long-term buyers. The fundamentals have not changed. Supply is fixed, almost all coins are already in circulation, and nothing about the core value proposition has weakened. What’s more interesting is what’s happening underneath the price. Spot Bitcoin ETF investors have largely been buying through the volatility, which suggests bigger players are treating this dip as an entry, not an exit.

What has changed is sentiment. Institutions have slowed down after a strong run earlier in the year, retail traders are nervous, and volatility has spiked. This combo usually creates the exact type of dip that long-term accumulators wait for.

So the picture right now is simple. Price is down, fear is elevated, and fundamentals remain intact. For anyone planning to build a BTC position through gradual buying, this environment is far more sensible than chasing the market near its peak.

So what does “enough BTC” actually mean?

Before throwing out numbers, it helps to be honest about why you are buying Bitcoin in the first place. “Enough” looks very different depending on the role BTC plays in your head and in your portfolio. Most people fall into one of these buckets.

The toe-dip

This is you saying, “I want exposure, I want to learn, but I am not trying to change my life with this.” It is a small amount of BTC that lets you participate in the upside, understand how wallets work, and feel involved without losing sleep if the price swings hard.

The diversification play

Here Bitcoin is just another asset. You already own stocks, maybe gold, maybe some cash, and BTC is there to improve long-term returns or hedge against traditional systems. You are less focused on the exact price and more focused on keeping the allocation sensible over time.

The long-term conviction hold

This is where Bitcoin starts to matter. You see it as digital property or long-term money and you plan to hold it for years, not months. Volatility is expected, drawdowns are tolerated, and the goal is preservation and asymmetric upside rather than quick wins.

The swing-for-the-fences bet

This is the high-conviction crowd. If Bitcoin works the way you believe it might, this position could meaningfully change your net worth. The trade-off is obvious though. Large gains come with equally large drawdowns, and not everyone is built for that ride.

Once you know which bucket you are in, deciding how much BTC to accumulate becomes a lot clearer and a lot less emotional.

Worked examples using realistic numbers

To make the above concrete, I will use a representative Bitcoin price of $86,754 to show USD equivalents. These numbers update with price changes so treat them as examples tied to the market at the time you read this.

Calculated values at P = $86,754

- 0.01 BTC = $867.54

- 0.05 BTC = $4,337.70

- 0.1 BTC = $8,675.40

- 0.5 BTC = $43,377.00

- 1 BTC = $86,754.00

- 5 BTC = $433,770.00

- 21 BTC = $1,821,834.00

Now map these to investor profiles.

Beginner / curious

- Goal: learn the market, small optional upside.

- Suggested target: 0.01 to 0.05 BTC. This is pocket-money sized for most people and a reasonable way to learn custody and exchanges without risking life-changing sums.

Balanced allocation seeker

- Goal: a scripted allocation inside a diversified portfolio.

- Suggested target: 0.05 to 0.25 BTC. For a 3 to 5% allocation in a $100k investable portfolio, that equates to roughly 0.035 to 0.058 BTC at the example price.

Core believer

- Goal: meaningful long-term store of value exposure.

- Suggested target: 0.5 to 1 BTC for investors who have moderate disposable capital and a strong conviction in Bitcoin as an asset class.

Maximum practical conviction

- Goal: life-changing upside.

- Suggested target: 5+ BTC but only for those who can tolerate enormous drawdowns and accept that this could easily fall to near zero in a worst case. Even aggressive allocators should think in percentages first, then check the BTC number against that percentage.

Why 0.1 BTC as a reasonable default target

If you asked me to pick a single pragmatic target that balances commitment and affordability for many readers, I would suggest working toward 0.1 BTC gradually. At the example price, that is around $8,675. That size does a few useful things.

- It is large enough to matter if BTC appreciates materially and small enough that a full loss will not break most diversified investors.

- It gives you skin in the game so you learn custody and tax implications.

- It is attainable via monthly dollar cost averaging for many people.

- Institutional and custody guidance suggests measured allocations and rebalancing which aligns with this middle-ground approach.

This is not investment advice tailored to your personal circumstances. It is a pragmatic heuristic many investors use when they want exposure without concentration risk.

Closing verdict: how many BTC should you aim for

There is no universal number that is perfect for everyone. That said, a practical rule of thumb for many readers:

- Shrimp: 0.05 BTC

- Dolphin: 0.25 BTC

- Whale: 1 BTC

- Giga Whale: 10 BTC

When you actually do buy, just convert your BTC goal into dollars using whatever the market price is that day. Start with a percentage of your investable net worth first, not a random BTC number you saw on Twitter. That step alone prevents most bad decisions driven by hype or fear.

Once you know the percentage you are comfortable with, turning it into a BTC amount is easy. Most large funds and professional advisors stick to small single-digit percentages for a reason. It keeps risk contained while still giving you enough exposure for Bitcoin to matter if it performs well over time.

One thing that genuinely helps is taking timing out of the equation. Instead of stressing about perfect entries, you can get paid in something stable like USDC, set up a simple daily or weekly BTC buy, and just keep stacking sats over time. That approach usually works better than trying to guess tops and bottoms. Tools like TOKU make this easy to set up, especially if your goal is to grow your Bitcoin position steadily without turning every market move into a monthly emotional rollercoaster.

Check out our quick breakdown of TOKU here!

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X