Could HBAR Be the Most Undervalued Coin Ready to 3X?

By Pratik Bhuyan Updated September 17, 2025

Summary

- Wyoming recently chose Hedera to power America’s first state-backed stablecoin, giving the network strong government-level validation.

- FRNT adoption could drive more on-chain activity, strengthen Hedera’s DeFi ecosystem, and increase long-term demand for HBAR.

- Combining all these factors with a possible ETF listing could potentially position HBAR to revisit its 2021 highs.

Introduction

If you’ve been following Hedera lately, you’ll know it just scored one of its biggest wins yet. The state of Wyoming picked Hedera as the official network for FRNT, America’s first state-issued stable token. And no, that’s not just another pilot or proof-of-concept. FRNT is backed by dollars and short-term Treasuries, overseen by a government commission, and designed to settle payments quickly and securely. In short, Hedera now powers a piece of state-level financial infrastructure.

That’s a huge validation for a network that’s always pitched itself as the enterprise-ready chain. But here’s the kicker: while the news made waves, HBAR’s price didn’t exactly moon overnight. It slipped a bit, reminding us that crypto markets don’t move just because of one headline. Still, the long-term implications of this choice are too big to ignore.

Why FRNT Matters

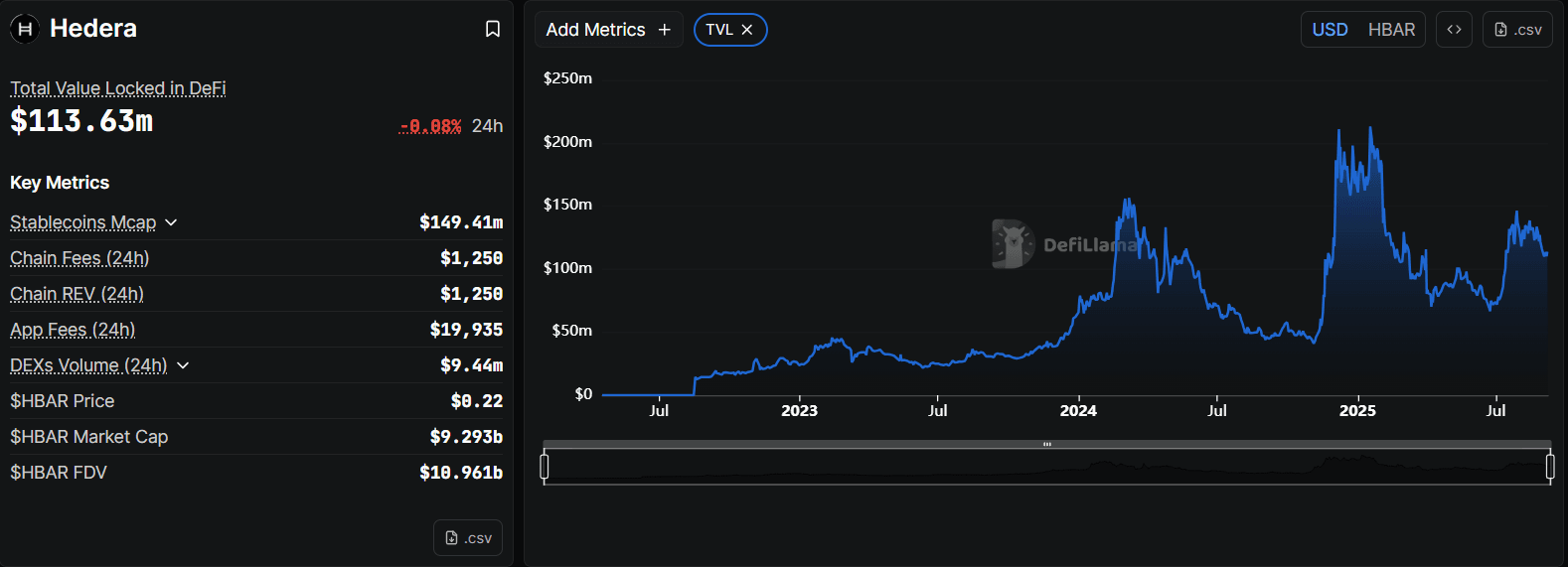

FRNT gives Hedera something most chains dream about: real value flows tied to dollars and regulated oversight. If it sees adoption, the result will be more on-chain transactions, higher demand for HBAR as gas, and stronger credibility in the eyes of institutions. That could spill over into Hedera’s DeFi ecosystem, which already holds more than $150 million in stablecoins. Liquidity attracts liquidity, and with new instruments like FRNT entering the mix, Hedera’s DeFi could gain real momentum.

At the same time, Hedera has been polishing its image. The HBAR Foundation is now the Hedera Foundation, the Governing Council has rebranded as the Hedera Council, and heavyweight groups such as Blockchain for Energy have joined.

Developer activity has been climbing in recent quarters, and platforms like SaucerSwap are gradually building liquidity and users. These may not grab headlines, but they are surely the building blocks of long-term growth.

Adoption Will Be the Decider

It is worth noting that FRNT did not launch directly on Hedera. The token went live on other blockchains first, with Hedera’s rollout coming later. That means investors will need to watch carefully for actual activity once it arrives. Will people use FRNT in volume, or will it stay symbolic? The answer to that question could determine how much impact this partnership really has on price.

Another factor to track is supply. Hedera has scheduled token unlocks from its treasury, and while these are transparent, they can put pressure on the market if demand does not scale in step. If ecosystem growth keeps up with those releases, the impact may be limited. If not, it could weigh on rallies. Recently though, the market seems to have absorbed these unlocks better, with prices showing less sensitivity to them.

So, Can HBAR Triple?

At the time of writing, with HBAR trading around $0.21, the bullish case looks compelling. If FRNT adoption expands, Hedera’s DeFi doubles in liquidity, and crypto sentiment turns supportive, HBAR could revisit its 2021 highs in the $0.40-$0.70 range. That would essentially be a 2-3x move from here.

The more conservative outlook is a steady climb into the $0.25-$0.40 range as adoption builds at a measured pace. The bearish case sees HBAR slipping back to the $0.14-$0.20 zone if FRNT struggles to gain traction or if markets weaken.

Extra Signals to Watch

Two additional developments highlight Hedera’s growing relevance. Swarm has partnered with the network to allow instant redemption of tokenized stocks like Apple and Tesla, showing how Hedera’s finality can support real-world asset markets.

Meanwhile, a spot HBAR ETF filing on Nasdaq and a new Robinhood listing have boosted retail attention, with HBAR jumping double digits after being added to the trading app. Although these projections are speculative, they still carry significant promise.

The Bottom Line

Wyoming’s decision to launch its state-backed stablecoin on Hedera is a strong endorsement of the network’s credibility. It signals that governments and institutions view Hedera as not only compliant with regulatory standards but also capable of powering real financial infrastructure.

This kind of validation matters because it moves Hedera beyond theoretical use cases and into the realm of live, institutional-grade adoption. While HBAR’s price might not immediately reflect the consequence, developments like this lay the foundation for sustained demand and could drive a major re-rating as usage accelerates.

Right now, HBAR sits at a crossroads. If adoption plays out, today’s levels could look like a bargain. If not, it may continue to trade sideways. Either way, Hedera has moved from being overlooked to being one of the few networks with state-level validation, and that alone makes it a story worth watching closely.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not represent the views of Beluga. Beluga does not endorse or guarantee any forecasts or predictions mentioned. Cryptocurrency investments involve significant risk, and you should only invest after consulting with a qualified financial advisor.

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X