Can Facebook Finally Launch its Stablecoin? Zuck’s Second Chance is Here

By Pratik Bhuyan Updated July 9, 2025

Summary

- The GENIUS Act creates a federal framework for stablecoins and includes a loophole that allows Big Tech subsidiaries to issue dollar-pegged tokens with minimal direct ownership.

- This opens the door for Meta to revive its stablecoin ambitions, which previously collapsed under intense bipartisan backlash.

- Meta could roll out its stablecoin across Facebook, Instagram, and WhatsApp to power instant payments, among other use cases.

The Ghost of Libra Rises

In 2019, Meta’s ambitious Libra stablecoin project collapsed under bipartisan fury. Lawmakers and global regulators decried its potential to undermine monetary sovereignty, while privacy advocates recoiled at the prospect of a surveillance-driven private currency. Libra’s ashes seemed final until now. The GENIUS Act, freshly passed by the Senate, has quietly resurrected Meta’s path to a stablecoin empire, embedding a loophole that permits Big Tech subsidiaries to issue dollar-pegged tokens with minimal direct ownership.

GENIUS Act: America’s Digital Dollar Defence

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) creates the first federal framework for stablecoins, aiming to cement U.S. dollar dominance amid global competition. Key pillars include:

- Dual Regulatory Pathways: Issuers under $10B in circulation can opt for state oversight, while giants like Meta face mandatory federal supervision by the OCC or Federal Reserve.

- 1:1 Asset Backing: Reserves must be held in cash, Treasuries, or insured deposits & no algorithmic experiments allowed.

- Non-Security Status: Stablecoins are explicitly exempt from securities laws, resolving years of regulatory ambiguity.

- Global Positioning: A direct counter to Europe’s MiCA regulations, which cap foreign stablecoin transactions at 1M/day to protect euro sovereignty.

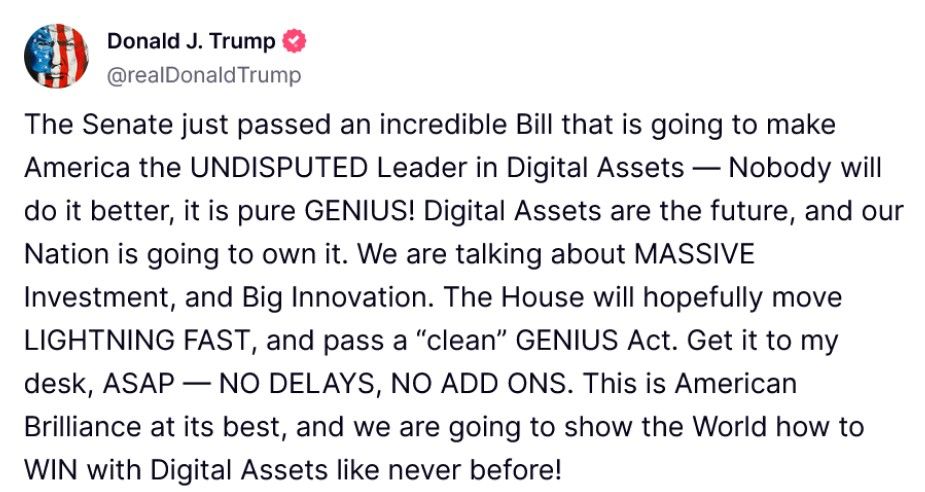

The Act now heads to the House, backed by the Trump administration’s public demand for a "clean" bill with "no delays".

Donald Trump’s Post on GENIUS Act on Truth Social

Donald Trump’s Post on GENIUS Act on Truth Social

Meta’s Open Door: The GENIUS Loophole

By leveraging its unmatched scale (nearly 4 billion users across Facebook, Instagram, and WhatsApp) Meta’s stablecoin could instantly become the world’s most accessible digital dollar. Seamlessly integrated for in‑app purchases, peer‑to‑peer transfers, and business transactions, it would allow Meta to bypass Visa and Mastercard fees entirely. At the same time, the rich trove of user spending data could be harnessed to fuel hyper‑targeted advertising, a practice that critics warn amounts to “surveillance pricing on steroids.”

Feature | Libra (2019) | Meta Stablecoin Under GENIUS |

Regulatory Approval | None; preemptive rejection | Federal license via OCC/Fed |

Backing Assets | Basket of currencies | U.S. dollars/Treasuries only |

Corporate Control | Consortium model | Subsidiary with Meta influence |

Political Climate | Bipartisan opposition | Trump administration support |

The Ecosystem Play: Meta’s Endgame

Though this is purely a guess, some possible options are:

- Instagram shops price goods in “Meta Dollars”

- WhatsApp users remit pesos via stablecoin

- Facebook ads offer instant checkout without banks.

For Meta, more than a currency, stablecoins are the key to an enclosed financial ecosystem, capturing value from every transaction while harvesting behavioral data.

Why Washington’s Stance Shifted

Meta’s revival was driven by three seismic shifts. First, the Trump Factor played a pivotal role: the former crypto skeptic rebranded himself as the “crypto president,” publicly endorsing the GENIUS Act as a means of securing U.S. digital dominance. In a Truth Social post, he praised it as “American Brilliance at its best.” His support wasn’t merely rhetorical; Trump-linked ventures like World Liberty Financial began issuing their own stablecoin, signaling a growing fusion of political power and financial innovation.

Second, global pressure accelerated U.S. action. With Europe’s MiCA framework boosting euro-backed stablecoins and China rapidly advancing its digital yuan, American lawmakers became increasingly concerned about the dollar’s fading influence. As legal expert Yuriy Brisov put it, “GENIUS ensures dollar-pegged stablecoins dominate global trade.”

Finally, industry lobbying proved decisive. It’s public information that in 2024, crypto super PACs poured $265 million into electing pro-digital asset candidates, successfully softening resistance in the Senate and laying the groundwork for broader regulatory acceptance.

Wrapping it Up

If the GENIUS Act becomes law, Meta would be looking at redemption: a chance to rebuild Libra’s vision within a regulated framework. It could be poised to integrate a dollar‑pegged token directly into its ecosystem, powering frictionless payments on Facebook, Instagram, WhatsApp and beyond. After years on the regulatory sidelines, the vision of a Meta stablecoin might at last be within reach, reshaping how billions interact, transact, and exchange value online. More broadly, the act just doesn’t revive Meta’s ambitions; it also opens the floodgates for other industry giants to enter the stablecoin arena, potentially transforming the future of digital finance at a global scale.

Join the Beluga Brief

Dive deep into weekly insights, analysis, and strategies tailored to you, empowering you to navigate the volatile crypto markets with confidence.

Never be the last to know

and follow us on X